The Weekly Random Walk – July 3, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Fireworks

Like most T-shirts made for Target, fireworks came from (you guessed it) China during the Song dynasty (960-1279)—the art and science of firework-making developed into an independent profession. In China, pyrotechnicians were respected for their knowledge of complex techniques in mounting firework displays. Those that were not successful or careless lost their ability to count to ten or wave to their neighbors (but their ability to give a fist pump was epic).

Nowadays, fireworks are used to celebrate the 4th of July and the independence of the United States of America.

Market Fireworks

As highlighted before, the equity market fireworks are coming from a handful of companies that continue to drive indexes like the S&P 500 or the NASDAQ higher. The top five companies in the MSCI US (Apple, Microsoft, Amazon, Nvidia, and Alphabet) now comprise 22% of the index, the highest since the tech bubble in 2000. Two stocks (Apple & Microsoft) now represent over 15% of the S&P 500 (cap-weighted)! JP Morgan reported this week that only 40% of the MSCI US stocks had delivered positive stock price returns over the last 12 months, despite the index being up more than 20% over the same time frame. This highlights just how narrow this market is.

Will There Be Red Fireworks Cause There All Green?

Over the last several weeks, there has been a correlation between the VIX and the S&P (last week, we saw the VIX fall with the S&P). Of course, usually, the VIX rises in a falling market. Over the last month, there has been a pronounced change in option buying as investors shifted to buying calls and selling puts, leading to a flattening of vol skew in both single names and the S&P Index. Thus, fear of missing the rally (remember FOMO) and end-of-quarter window dressing have been the dominant concern. Greed is abundant in equities right now.

It's High

No, we are not talking about a surfer on the California coast; we are talking about the S&P Index’s Price Earnings Ratio (P/E). Despite the backdrop of the FOMC and their hawkish talk, the market still thinks that rate cuts are coming soon. So, the index continues to climb and has gone from 17x 2023 earnings to right at 20xs. But earnings (although more robust than expected) have dropped from $59 to $53 after Q1 reports. So, we would argue that if the economy continues to slow and earnings see any negative revision, then the S&P multiple would move above 20x without trading one cent higher from here. In essence, the market has wholly baked in rate cuts, a soft landing (rate cuts and a soft economic landing are a paradox), and earnings that continue to show positive year-over-year growth. Come to think of it; maybe many investors have turned into surfers too.

No Need to Run After You Light the Fuse, Everything is Fine

To put the greed/fear issue another way, we looked at downside equity protection this week, and it didn’t surprise us to see equity protection trading at pre-pandemic levels. Out-of-the-money, 90% strike, implied volatility closed at 20.6%, well below the average level over the last three years. Investors appear to have capitulated on being short (the market has a heavy imbalance to the long side of the book) after the debt ceiling debate and banking issues (source: Bloomberg).

BANG!

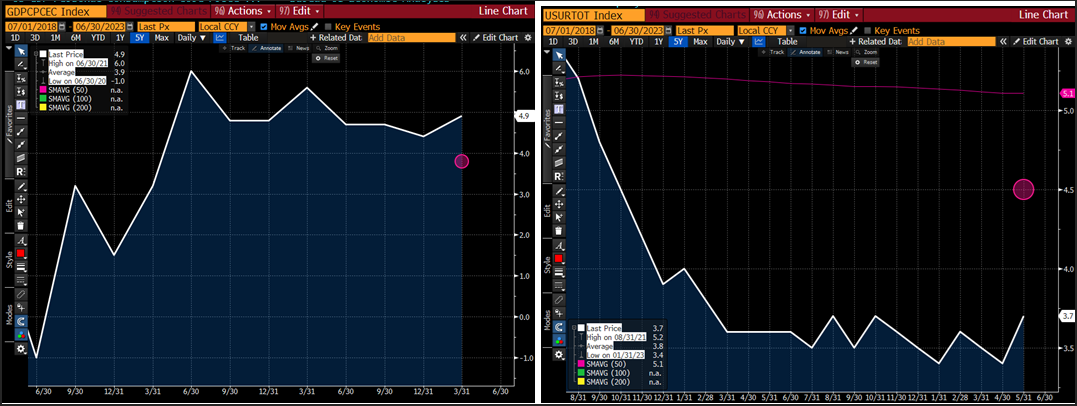

Listening to Chairman Powell again this week, it seems clear that the Fed is struggling with two issues, Core PCE and US Unemployment. Since December, the trajectory has been higher and not lower (note: we did see a slight 0.1% downtick in the last report). Chairman Powell in Central Bankers panel stated that the Core PCE is in the Fed’s crosshairs, with inputs into Core PCE being rents and wages. The charts below show the FOMC target(s) in purple. Unemployment (U3) is finally starting to tick higher, but a long way from the 4.5% unemployment target they want.

Although we thought the Fed was done (and would hold) hiking rates, another 25-50 bps may be in the cards.

Oohs & Aahhs

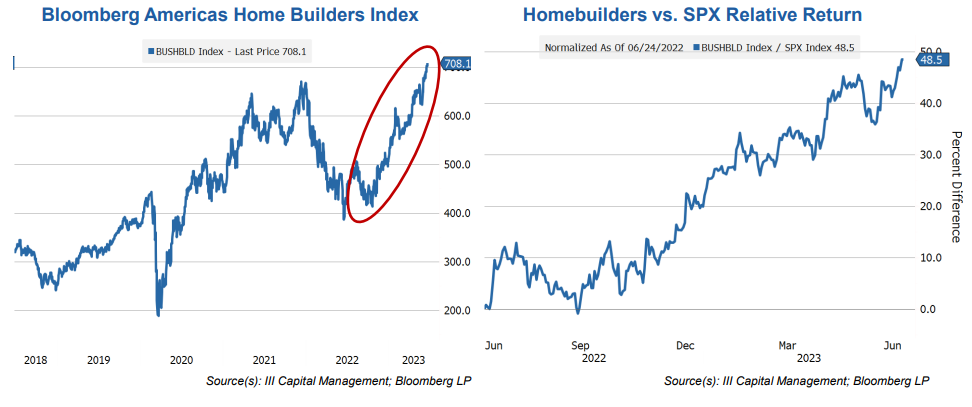

New home sales have been outperforming existing and pending home sales as unprecedentedly low inventories send buyers into the arms of homebuilders (despite higher rates). However, expectations were for a modest 1.2% month-over-month decline in May, but instead, they exploded (yes, there’s a pun) up 12.2% MoM. This is the third month of gains, sending new home sales up 20% year-over-year.

The average home sells for $416,300, and mortgage rates (for now) are holding steady at 7.17%.

This surge in new home buying has helped homebuilder stocks. The Bloomberg Home Builders Index hit a new high this week and, other than tech names, has been the “best of the rest.”

Hey, If We Drive Across State Lines, We Can Get Fireworks at Steve’s Fire Shack!

Another reason why the Fed needs help to tame inflation is the continued M1 (money supply) in the system. Citi Group estimated that “excess savings” from various COVID stimulus has fallen from 2.5 trillion to 1.5 trillion dollars. That’s still a tremendous amount of money in the system waiting to find a home. If Citi is accurate, this may be sufficient to keep service expenditures (like going to restaurants) elevated for a few more quarters. In addition to a tight labor market, this may help explain why non-shelter services inflation remains elevated. As Chairman Powell said this week, “We still have a long way to go in the fight against inflation.”

That’s a Mean Looking Firework

Anytime we see large deviations away from the mean (or moving averages), it draws our attention. Case in point, looking at the chart below, the S&P 500 is well above its 50 and 200 DMA (day moving averages). The good news is that we believe this rally is not a bear trap but think that a correction back to the moving averages is likely (and prudent) for the reasons we have discussed.

A correction would give some companies that have lagged a chance to “catch up,” maybe some of the investment flow into technology companies goes into value or defensive names. Either way, the “charts don’t lie,” and it would seem reasonable to see a pull-back.

Grand Finale of This and That

How can so few stocks push the market higher? Look at these first-half returns:

- NVDA: +190%

- META: +138%

- TSLA: +113%

- AMZN: +55%

- AAPL: +50%

- MSFT: +43%

- GOOGL: +36%

A lot of economists, including us, are having a hard time predicting the economy’s direction because the data is not leading us to a common theme. Even though new home sales are robust, the Bloomberg Subdial Watch Index, which tracks prices for the 50 most-traded watched by value on the secondary market, continues to fall from its highs in April 2022. Luxury brands like Louis Vuitton warned about slowing sales as well. So, it leads us to wonder if the luxury bubble is starting to burst or if, like fireworks, the Chinese are making knock-off watches so good that people are not buying real ones anymore (yes, it’s a joke, but not really).

ESG or BSG? That is the question. For now, Larry Fink, the CEO of Blackrock, is abandoning the term after he acknowledged that Governors like Ron DeSantis, who have yanked over 4 billion in assets from asset manager, have put the term (ESG) in the crosshairs and he is “ashamed” to be part of the debate. It may be helpful for Mr. Fink to remember that he put himself in this position through his very own policies and using what should have been a noble effort as a marketing ploy (see former Blackrock Head Tariq Fancy’s paper on the hypocrisy of the firm). We doubt this fight is over and hope to see investments that can make a real impact. We are just happy we can write about it honestly and transparently.

This week, I was able to parlay work in Baltimore with a trip to (again) see my Midshipman in Annapolis. This year, I watched the class of 2027 (like my Mid did two years ago) come onto “The Yard” (Naval Academy) with a calling to do something bigger than themselves. They are making a sacrifice for this country. They are protecting and serving this great nation. These great young men and women are from all walks of life. Those who come to the service academies are the best this nation produces, and it was once again an honor to watch the indication ceremony. I wish the plebes of the Class of 2027 and their families the best of luck this summer and in the future.

As we celebrate the 4th, remember the soldiers standing watch (on the ground or the sea) so we can cook burgers and watch fireworks. I hope that during the day, you think (and pray) for them.

Be safe and Happy 4th of July.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.