The Weekly Random Walk – June 26, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Summertime

DJ Jazzy Jeff & the Fresh Prince (Will Smith) said it best:

“Summer, summer, summertime

Time to sit back and unwind (summertime)

Here it is a groove slightly transformed

Just a bit of a break from the norm

Just a little somethin’ to break the monotony

Of all that hardcore dance that has gotten to be

A little bit out of control, it’s cool to dance

But what about the groove that soothes that moves romance

Give me a soft subtle mix

And if ain’t broke then don’t try to fix it (don’t try to fix it)

And think of the summers of the past

Adjust the bass and let the Alpine blast

Pop in my CD and let me run a rhyme

And put your car on cruise and lay back ‘cause this is summertime.”

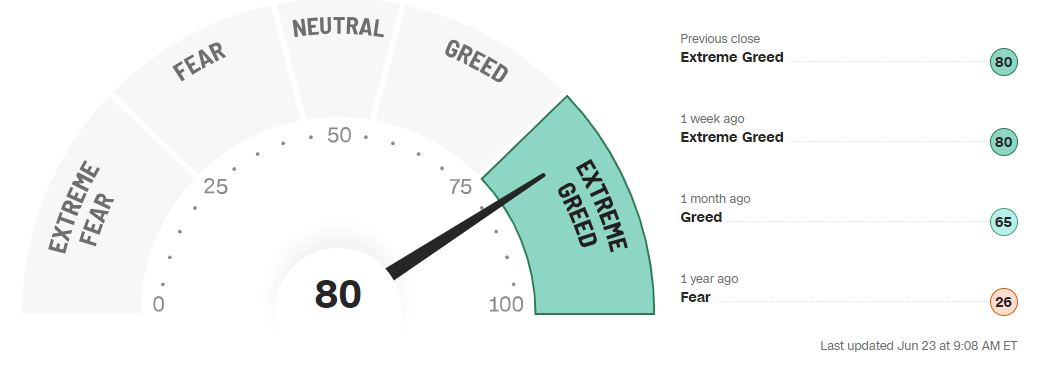

More Greed, Less Fear

I got positive comments on this chart I shared a few weeks ago, so I have updated it for this week’s random walk. The Green Index has risen over the last ten days of trading and now sits at 80. To put things into perspective, just a year ago, the index was in the “Fear” range at 26.

After this week, market momentum has slowed (slightly) as the S&P has come off its YTD highs.

Bouncing and Behaving

The market is expanding away from the seven or eight stocks driving the NASDAQ and S&P 500. Over the last few weeks, small-cap equities (the ETF for the index is “IWM”) staged a significant bounce over the previous few weeks versus the broader indexes. After underperforming the SPY, small caps have started to recover but are still below the major benchmark. In a sign of what we think is desperation and fear of missing the rally (FOMO), investors have turned to IWM options to get exposure by buying a record number of calls.

Domo arigato, Mr. Roboto

Goldman Sach’s research did a baseline estimate for the increase in annual productivity arising from the development of AI. Their report estimates a 1.5% increase, which is on par with the productivity from the electric motor and personal computer (though, like those technologies, it may take up to 10 years to achieve that productivity growth fully). The productivity growth is expected to arise from workers partially exposed to AI automation, using their freed-up capacity towards productive activities that increase output (no, ChatGPT didn’t help us write this). Workers are likely to be displaced (aka lose their jobs) by AI and automation. The question becomes what new jobs open up or is the beginning of what politicians call a “living wage” paid to those whose lives have become worthless because of AI.

Lots of underperformance

The technology sector is once again dominating the headlines and the indexes with stellar YTD stock market performance, prompting some to wonder about a bubble in valuations. Multiples have expanded, and companies like Apple, Microsoft, Tesla, Meta, Nvidia Alphabet, and AMD have driven almost all of the S&P and NASDAQ index performance. The good news is that these companies have enjoyed dominant earnings and some of the highest margins available to investors.

However, any investor with a diversified portfolio has underperformed (by a large margin) in most of the major indexes because of the price-weighted nature of these benchmarks. We worry that the fear of underperformance shifts allocation to a handful of companies, thus skewing asset allocation out of balance.

Despite the stability and growth of these companies, we urge caution in chasing because, eventually, we anticipate mean reversion and a market that rebalances.

And Now for the Rest of the Story

To put an exclamation point on just how narrow the market has been, Morgan Stanley reviewed year-to-date EPS, and this is what they found; the S&P 500 has risen over 16% over the last six months, even though EPS (earnings per share) is now flat. Historically, the S&P performance has been flat when EPS is flat (but not this year). Morgan Stanley predicts that forward EPS will likely fall even further in the coming months, meaning a likely fall in the S&P 500 from these levels.

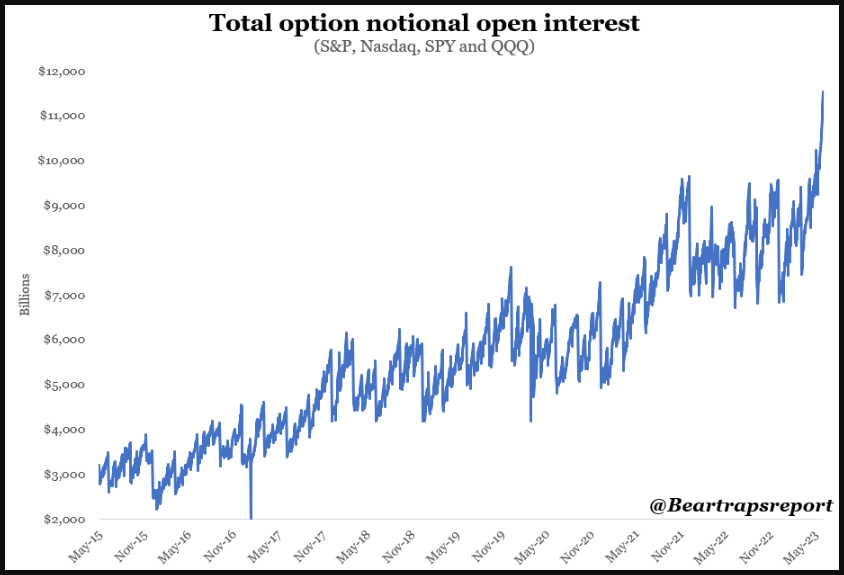

Zero-Day Options and Volatility

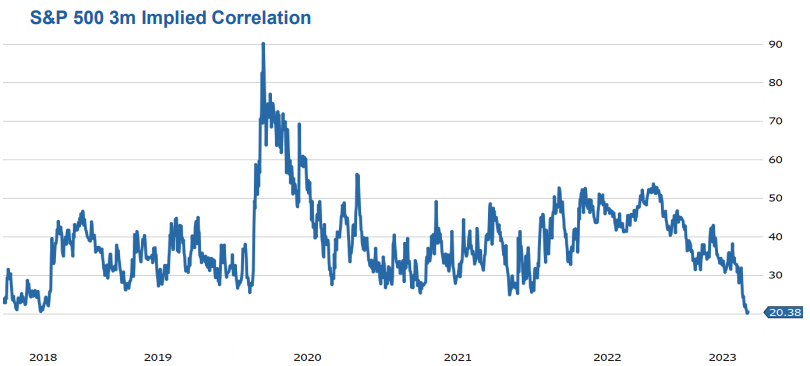

As we have highlighted, volatility suppression from selling short-dated index options is helping keep a lid on the VIX. Still, it is also driving implied correlation to new multi-year lows. Measuring implied correlation (how closely the index components track against one another) offers insight into the relative cost of index options compared to the prices of options on individual stocks that comprise the index. While realized correlation within the S&P has fallen, the heavy selling of index options has helped to lower implied correlations.

These zero-day options have put a bid under the market. But the interplay between the 11 trillion passive investments and the 0DTE (zero-day option) could create a ticking time bomb. There are alarming unintended consequences of automated buying by passive investments and the surging options volumes. Both work together in a self-reinforcing feedback loop to artificially distort risk indicators (VIX) by suppressing equity volatility. This is starting to cause a massive buildup of one-sided overcrowded long-positions. Markets work best when there is balance (not too long or too short), and that’s not where we are today (way too long).

The derivative and options market is now at record levels in terms of notional dollars. These products have (in the past) caused much damage to markets because of greed. Warren Buffet famously said, “Derivatives are financial weapons of mass destruction.” We hope greed doesn’t kick in this time and these products remain contained.

Shake Your Tail-Risk Feathers

Even though equity volatility (VIX) remains low, interest rate volatility continues to be elevated. This volatility has come down in recent weeks since the regional banks appear to have stabilized (for now). So even if tail-risk has subsided, rate markets continue to maintain a much higher level of volatility as the market grapples with the path of the Fed and other central banks (which appears higher). Central banks (like the BoE) remain in hiking mode, and QT continues to remove liquidity. We are now starting to see the additional Treasury issuance following the debt limit deal, and we continue to believe that risk assets may experience elevated volatility in the coming months. Remember, summertime volumes are generally lower, which can create more significant intraday moves in markets.

The Fed is the Cushioning the Blow

As new bills are being issued, the Fed’s current hawkish stance is limiting the impact on risk assets in the short term. Whether intended or not, the Fed’s “hawkish pause” has helped money flow into money market funds, thus absorbing some of the new issue T-bills. These T-bills currently yield at or better rates than RRP (reverse repo) and offer better liquidity. So, money market funds are drawing down on the reverse repo and buying the new T-bills offered by Treasury.

Put On Your Sunscreen

Sticking with the song theme this week, we could use Pink Floyd’s “All in all, you’re just another brick in the wall” – to describe the growing number of countries entering the BRICS monetary platform. Over the last few weeks, South Africa has indicated they want to join the alliance. Currently, 25 nations (on top of the five principal nations) have applied for status. We have heard the naysayers talking about continued dollar dominance, but Western economies are getting nervous as this platform’s popularity could realign the global geopolitical system.

We highlighted volatility this week because of the anomalies seen over the past two weeks. As the GS derivatives team points out, “ten-day realized correlation is +0.61 (positive)…this is in sharp contrast to the average realized correlation over the past 30 years, which stands at -0.78 (negative).” Something is just not right.

Valuations do/will matter. When looking at the S&P 500, the mean PE ratio of the seven mega-cap stocks (AAPL, MSFT, AMZN, GOOGL, NVDA, TSLA, and META) is 31xs earnings. The rest of the 493 stocks have an average PE of 17xs, bringing the average earnings of the index to 24xs. The market has been very narrow.

We continue to believe the equity market has gotten ahead of itself. Could it go higher? Absolutely. Should it go higher? Perhaps not. The CNN Fear/Greed Index has been historically pretty accurate regarding “overbought/oversold,” and we are overbought. Despite a lower market last week, we think a 5-10% pullback from highs a few weeks ago is not a stretch. For traders, the market may allow you to reposition for opportunities as we head into interesting economic conditions at the end of this year.

Lastly, unless you own the NASDAQ index (QQQ) or the S&P Index (SPY), your portfolios have not matched the indexes. Diversified portfolios (which is prudent) are not currently matching the narrow market. We think managing to “minimize max-drawdown” versus “chasing returns” is a better way of managing portfolios. Mean reversion will eventually take hold. It’s just math.

As always, be careful and trade well.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.