Last Week in Review – July 3, 2023 – from Stephen Colavito

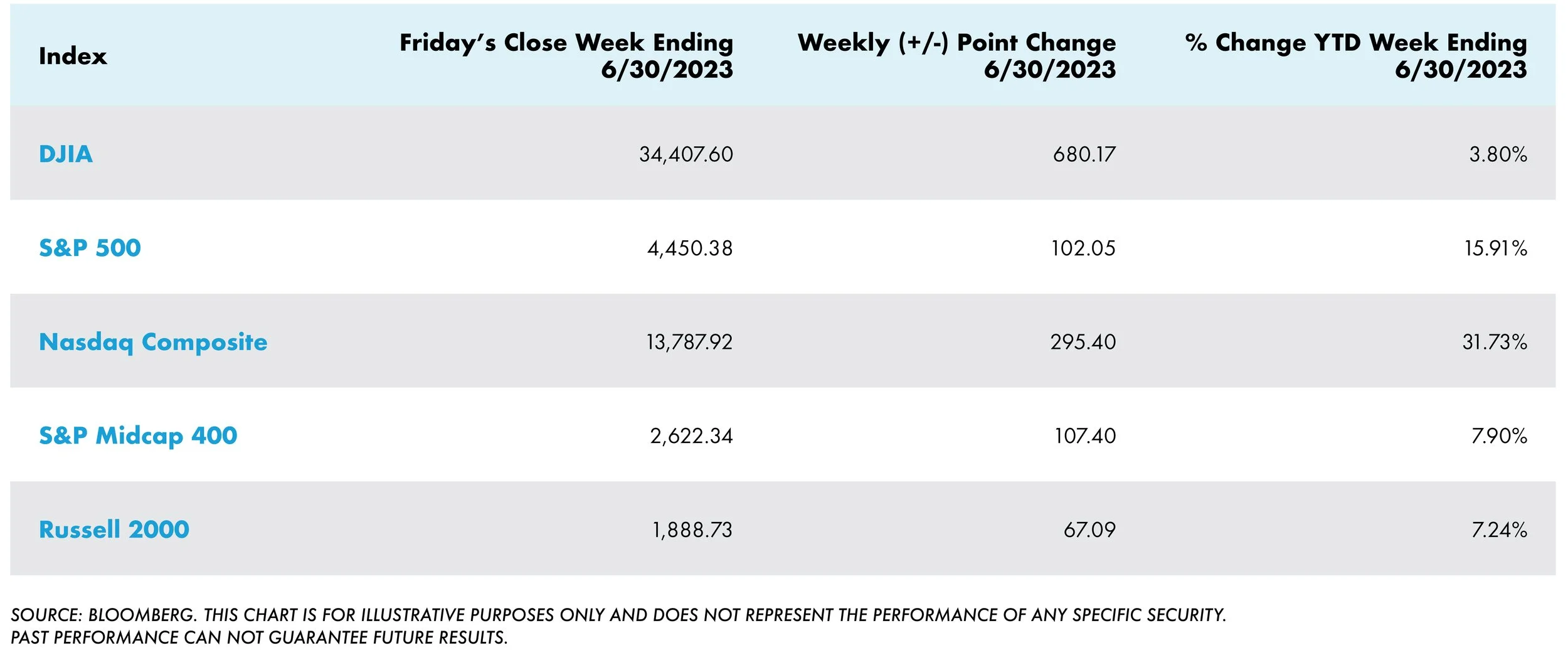

Positive growth and inflation surprises helped the major benchmarks round out a solid quarter on a high note, with the S&P 500 Index recording its best weekly gain since the end of March. Last week’s rally also broadened, with small-caps and value shares outperforming and the equal-weighted S&P 500 Index handily outpacing its market-weighted counterpart. The technology-heavy Nasdaq Composite remained well ahead of the other benchmarks for the year-to-date, however, ending the week with a six-month gain of nearly 32%, its best start to the year since 1983.

Notably, Apple closed trading Friday with a market capitalization above USD 3 trillion, marking a first for a publicly traded company. The Wall Street Journal reported that Apple’s valuation had surpassed five of the S&P 500’s 11 sectors (materials, real estate, utilities, energy, and consumer staples).

US - MARKETS & ECONOMY

Inflation data released last Friday appeared to provide the most significant boost to sentiment. The Commerce Department reported that its personal consumption expenditures (PCE) price index had increased by 0.1% in May, bringing its year-over-year increase down to 3.8%, its lowest level since April 2021. The core (excluding food and energy) PCE index, considered the Federal Reserve’s preferred inflation gauge, fell back to 4.6% on a year-over-year basis, still well above the Fed’s 2% target, but this seemed to calm fears of the market as it was worried about a reacceleration in price pressures after April’s upside surprise.

Among the other signals of strength in the week’s heavy economic calendar:

Private sector incomes rose 0.5% in May, according to Commerce Department data, well in excess of a 0.1% increase in consumer spending.

Weekly jobless claims defied expectations and plummeted by 26,000 from a 20-month high to 239,000, marking the sharpest drop since October 2021. Continuing claims also surprised on the downside and fell back to a four-month low.

The University of Michigan revised its gauge of consumer sentiment higher, pushing it to its best level in four months. The survey’s chief researcher attributed the “striking upswing” to resolving the debt ceiling standoff and “more positive feelings over softening inflation."

Durable goods orders rose 1.7% in May, defying consensus expectations for a decline of around 1%. Notably, orders excluding the volatile defense and aircraft segments—widely considered the best proxy for business investment—rose 0.7% after falling the previous month.

Similarly, May new home sales easily outpaced estimates, rising 12.2% in May, well above expectations for a modest decline and at the fastest pace since February 2022, when rates for a fixed 30-year mortgage were nearly 300 basis points (three percentage points) lower.

US – EQUITY MARKET PERFORMANCE

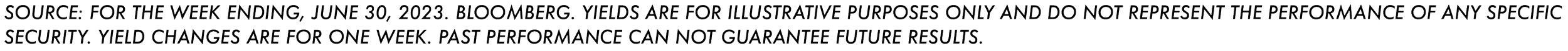

US YIELDS & BONDS

What was good news for equity investors was bad news for the Treasury market, as the data helped briefly push the yield on the benchmark 10-year note to 3.87 in intraday trading on Friday, its highest level since March 9. (Bond prices and yields move in opposite directions.)

According to traders, sentiment around tax-exempt municipal bonds deteriorated early in the week after a judge in Puerto Rico delivered a ruling in a bankruptcy case involving utility bonds that were perceived as unfavorable to bondholders. (Munis issued by Puerto Rico are widely held because their income is tax-exempt in most states.) However, municipal bonds outperformed Treasuries later in the week, and Muni-Treasury ratios ultimately richened. The final sale of municipal bonds held by the FDIC after taking a few regional banks into receivership earlier this year reached the market on Thursday, which bolstered sentiment.

The investment-grade corporate bond market saw low issuance levels before the holiday. Those that did come to market were met with solid demand, as midweek issuance was oversubscribed, and spreads consistently tightened throughout the week despite the rate volatility.

Broad risk-on sentiment supported the high-yield market’s performance, with investors trying to source paper ahead of quarter-end and manage cash levels given that no-issuance was expected until after the Independence Day holiday. In the bank loan market, managers of collateralized loan obligations mainly focused on lending at a discount and drove most of the buying.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth -0.01 bps to 5.28%

2-yr: +0.16 bps to 4.90%

5-yr: +0.17 bps to 4.16%

10-yr: +0.12 bps to 3.84%

30-yr: +0.05 bps to 3.86%

INTERESTING NEWS OVERSEAS

In local currency terms, the pan-European STOXX Europe 600 Index rallied 1.94% last week on hopes that China would do more to boost consumption and that lower-than-expected inflation data could mean that interest rates are near their peak. Major stock indexes also posted gains. France’s CAC 40 Index advanced 3.30%, Italy’s FTSE MIB climbed 3.75%, and Germany’s DAX increased 2.01. The UK’s FTSE 100 Index added 0.93%.

European government bond yields held near the week’s highs as inflation eased but remained above the European Central Bank’s (ECB) 2% target. The yield on the benchmark 10-year German government bond approached 2.4%, while the yields on Italian sovereign bonds of the same maturity ended near their weekly highs despite data indicating that confidence among manufacturers had weakened.

Annual inflation in the eurozone slowed for a third month in June to 5.5% from 6.1% in May, according to an initial estimate from the European Union’s statistics office. The result was lower than the 5.6% forecast by economists polled by FactSet. Core inflation—which excludes energy, food, alcohol, and tobacco prices—ticked up to 5.4% from 5.3%.

News reports from the ECB’s annual Forum on Central Banking suggested that policymakers are still likely to vote for another interest rate increase in July. ECB President Christine Lagarde acknowledged that the central bank had made “significant progress” in combating high inflation but asserted that policymakers “cannot declare victory yet.” According to Lagarde, uncertainty over how tight labor markets and significant wage increases will influence price means "it is unlikely that in the near future, the central bank will be able to state with full confidence that the peak rates have been reached.” Even so, some Governing Council members, including Vice President Luis de Guindos, opined that another hike in September was less certain, depending on incoming economic data

Japan’s stock markets gained over the week, with the Nikkei 225 Index rising 1.2% and the broader TOPIX Index up 1.1%. Halfway through 2023, Japanese equities were among the world’s best performers in local currency terms, although the yen weakness, to a degree, moderated returns in U.S. dollar terms.

Japan’s monetary authorities stated that every option is on the table to cope with excess volatility in the foreign exchange markets, as the Japanese currency fell to a seven-month low of around JPY 144.8 against the U.S. dollar. It briefly hit the JPY 145 level, prompting the Bank of Japan (BoJ) to undertake a yen-buying intervention in September 2022. This led to investor anticipation that the central bank would again step in. While Japan’s monetary authorities said they were watching currency moves with an extremely high sense of urgency, no concrete action was forthcoming.

Lastly, stocks ended mixed in China, as weak economic indicators offset optimism that the government might implement additional measures to bolster economic growth. The Shanghai Stock Exchange Index gained 0.13% in local currency, but the blue-chip CSI 300 lost 0.56%. In Hong Kong, the Hang Seng Index inched up 0.14%.

THE WEEK AHEAD

The upcoming week will be filled with important releases in the United States, including the FOMC meeting minutes, the US jobs report, and ISM PMI surveys for June. The FOMC meeting minutes, scheduled for Wednesday, should provide further insights into the Federal Reserve's monetary policy trajectory. On the economic data front, non-farm payrolls are projected to increase by 200 thousand in June, the lowest since December 2020, while the unemployment rate is expected to remain unchanged at a seven-month high of 3.7%. Additionally, the ISM reports are likely to indicate a modest increase in service sector activity but a decline in manufacturing output. Other data to monitor include May's job openings, factory orders, foreign trade data, June's ADP employment change, and the final readings of PMI data from S&P Global.

Stephen Colavito

Chief Investment Officer

San Blas Securities

This message is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, which is available upon request.