The Weekly Random Walk – July 10, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Tour de France

July is our favorite time of the year for sports. Being the Euro-freaks we are, there are three Formula One races in July, Wimbledon, and the Tour de France.

The Tour de France runs most of the month and is considered the most prestigious of the Grand Tours

(the Super Bowl of bicycle racing). The race is also the oldest, as it was first organized in 1903 to increase sales for the newspaper L’Auto (one has to love media companies). It comprises 21 stages over 23 or 24 days, with the route covering over 3,500 kilometers (2,200 miles). The rider with the lowest cumulative time is the race leader, wearing the yellow jersey. The scenery and pageantry are extraordinary for those who have never seen the race in person (or even on TV).

The winner of the race has the stamina for the day-to-day grind of hot days and long miles. Like what we are seeing with the economy and markets, let’s begin.

Col du Torumalet

As discussed over many weeks, technology stocks have led the indexes higher as AI has become the “dot- com” of 2023. The NASDAQ five-year chart below shows the rapid increase in value this year, looking like a Col the riders in the tour have climbed. The purple line represents the 50-day moving average (DMA); as you can see, the market is well above that level.

To add to the chart above, after a blistering 40% rally in the year’s first half, the NASDAQ is now at overbought levels and extreme positive sentiment. The difference in the Daily Sentiment Index (an index that calculates using moving averages) between the NASDAQ and the S&P 500 is at a 23-year high. Even though the NASDAQ is 10% below its 2021 high, investors should be wary of extreme readings when investing new capital.

Cycle-Lows (Magical Pun)

The S&P 500 rose 6.5% in June while the ten-year Treasury yields rose 20bps. This has led to the lowest equity risk premium (ERP) in 12 years. The ERP is currently at 0.89% (12 months earnings yield minus the ten-year treasury yield). In the 1990s, when yields were higher, the ERP went into negative territory so the market could see a lower number. However, it does bring into question the relative value of equities versus Treasuries (another caution sign).

Summer Lows

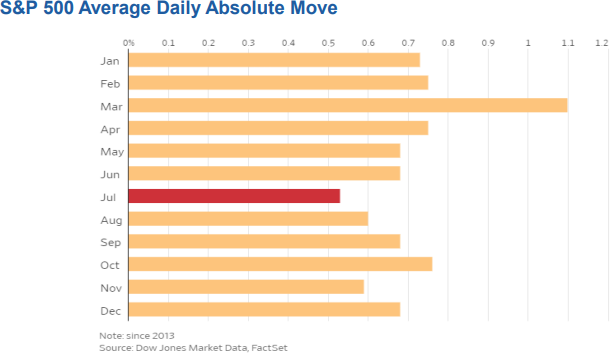

Market seasonals may partially explain the current low levels of implied volatility in equities. Historically, July has delivered the lowest absolute moves in the S&P 500 index over the last ten years. Interestingly, March has been the most volatile month, generating almost 2x the daily moves in July. Lower trading volumes can partially explain this phenomenon.

Pelotons, Cars, and lots of Debt

During Covid, many people pulled out their credit cards, wore yellow jerseys, and bought a Peloton stationary bike. These days people are buying new cars; however, in a recent report, payments have hit a new record exceeding $1,000 per month as record borrowing costs continue to rise and new car prices remain elevated.

Edmunds’ second-quarter data shows that 17.1% of consumers who financed a new car signed on for four-figure monthly payments. This now stands as a record high (before Covid, it was 4.3%). Those who agreed to pay over $1,000 monthly have an average APR between 8.5% - 9.6%. With auto-delinquencies rising, we wonder if banks are getting desperate for high-yielding loans to boost their earnings.

So, while some drive in their high-priced EVs and pay $1,000 monthly, other cash-strapped Americans are headed to the pawn shop. The term “pawn shop near me” was a search trend that spiked in July in an ominous sign that consumers might be pawning items or selling things (maybe the Peloton that was never used). States like Georgia, Louisiana, Mississippi, and California were among the highest searched using Google’s algorithm.

Moving Together

Since 2018 and the accumulation of bullion by sovereign nations, we saw this chart on Visual Capitalist and needed to share. We found the relationship between gold prices and the US national debt interesting.

Although numerous other factors can influence gold prices, it’s interesting to see the correlation between the two. The easy thesis is that inflation concerns rise as the national debt increases. When a government accumulates a significant amount of debt, it may resort to measures such as printing more money or increasing government spending, potentially leading to the debt death spiral and dilution of fiat currency (but don’t tell anyone in DC about this).

It’s an interesting chart.

One Kilometer To Go (aka Bullet Points)

Last week, former Treasury Secretary Larry Summers warned against any sense of achievement by policymakers in bringing inflation down notably from its peak last year and predicted a further selloff in bonds as investors adjust to the need for more monetary tightening. Summers spoke after the US jobs report on Bloomberg, in which he characterized the report as a “hot” set of numbers.

After almost depleting the Strategic Petroleum Reserve (SPR), it appears the Biden administration is getting the memo from the Pentagon that levels are now at “dangerous levels” and putting the country at risk. Shortly after that news, cuts were announced from both Saudi Arabia and Russia as oil futures markets started to strengthen, suggesting that the oil market tightening may be on the way.

Statista did a recent survey and found that almost 40% of Americans (who took the survey) have less than $1000 in their savings accounts. Another 18% have less than $10,000 in their savings accounts. If this survey is accurate, how can car buyers pay $1,000 monthly in car payments (see above) – unless we live in the Matrix?

Lastly, we are still in the camp that a correction is needed, and the market is overbought territory, but momentum can be funny. Clearly, “FOMO” is alive and well. Still, it’s hard to understand how valuations, even in some of these technologies’ names, can be justified with continued rate increases on the horizon. Sometimes irrational buying (or selling) can usurp fundamentals, and we think this is one of those times. So, for any new money going into the market, we suggest a dollar-cost-averaging strategy over the next three to six months.

Be careful.

Trade well.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.