Last Week in Review – June 5, 2023 – from Stephen Colavito

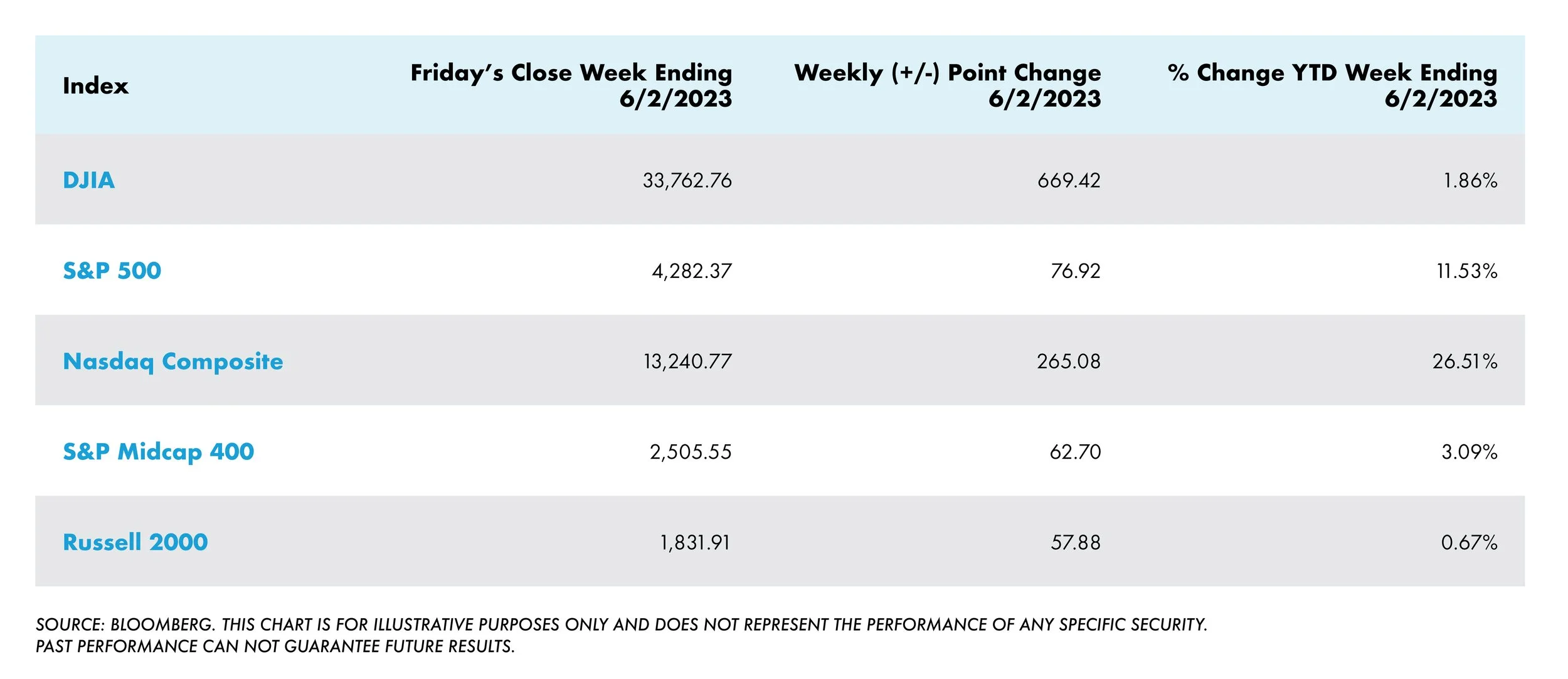

The major benchmarks ended with solid gains last week, with the S&P 500 Index touching its highest intraday level since mid-August 2022. The technology-heavy Nasdaq Composite Index notched its sixth consecutive weekly gain and hit its best level since mid-April 2022. In contrast with the past several weeks, however, the rally was broad-based, with solid gains in value and growth stocks and small caps. Markets were closed on Monday in observance of Memorial Day.

News that the White House and Republican congressional leaders had reached an agreement over the preceding weekend to raise the federal debt limit and stave off a default on governmental obligations seemed to have limited impact on sentiment—perhaps because enough signals had previously emerged that a deal was imminent. The House of Representatives passed the bill by a surprisingly large margin on Wednesday, which seemed to have limited impact on markets. After the Senate’s passage of the measure late Thursday, the bill headed to President Joe Biden, which he signed on Friday.

US - MARKETS & ECONOMY

Investors appeared to return their attention to economic data. On Wednesday, stocks pulled back following news that job openings rebounded much more than expected in April and hit their highest level (10.1 million) since January. March’s data were also revised higher. T. Rowe Price traders noted that the probability of a mid-June Federal Reserve interest rate hike priced into futures markets jumped to 71% on the news—compared with only 23% a month earlier.

Friday’s closely watched nonfarm payrolls report also surprised to the upside, but the details in the report suggested that the labor market might be cooling. Employers added 339,000 jobs in May, well above consensus expectations for around 190,000. But the unemployment rate—estimated by surveys of households—also surprised by rising to 3.7% from 3.4%. Suggesting a more difficult job market for workers, the Labor Department reported that the number of people losing jobs or completing temporary jobs jumped significantly in May and reached its highest level since February 2022. The number of longer-term unemployed remained relatively constant, however.

Another encouraging sign for interest rates and investors was the release Thursday of the Institute for Supply Management’s (ISM’s) Manufacturers Purchasing Managers’ index for May. As expected, the ISM’s gauge showed a seventh straight monthly contraction in factory activity. Encouragingly, however, prices paid for supplies and other inputs by manufacturers contracted at the fastest pace since December, defying expectations for a modest increase.

US – EQUITY MARKET PERFORMANCE

US YIELDS & BONDS

The encouraging inflation signals appeared to drive a decrease in longer-term U.S. Treasury yields. At the same time, the finalization of a debt ceiling agreement led to a plunge in the yield on one-month Treasury bills, from 6.02% intraday the previous Friday to 5.28% at the end of the week. The debt ceiling agreement provided an additional tailwind to the municipal market.

New issuance was front-loaded in the investment-grade corporate bond market, with a sizable offering from retailer CVS. Early redemptions, coupon payments, and tenders added over USD 6 billion to the high-yield bond market this week and supported prices. Positive developments in the debt ceiling negotiations also bolstered the performance of broader risk markets. The primary market was quiet with limited issuance, as more new deals are expected to be announced next week.

Buyers emerged in the bank loan market amid the broader risk rally after the debt ceiling bill passed the House, and investors turned their attention to monthly jobs data. Idiosyncratic situations drove most of the secondary loan market’s activity.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth +0.12 bps to 5.35%

2-yr: -0.06 bps to 4.50%

5-yr: -0.09 bps to 3.84%

10-yr: -0.11 bps to 3.69%

30-yr: -0.07 bps to 3.89%

SOURCE: FOR THE WEEK ENDING June 2, 2023. BLOOMBERG. YIELDS ARE FOR ILLUSTRATIVE PURPOSES ONLY AND DO NOT REPRESENT THE PERFORMANCE OF ANY SPECIFIC SECURITY. YIELD CHANGES ARE FOR ONE WEEK. PAST PERFORMANCE CAN NOT GUARANTEE FUTURE RESULTS.

INTERESTING NEWS OVERSEAS

In local currency terms, the STOXX Europe 600 Index was little changed. The pan-European index clawed back losses after data showed that eurozone inflation had slowed, and the U.S. Senate approved a bill to suspend the statutory limit on government borrowing. Major stock indexes were mixed. The UK’s FTSE 100 Index eased 0.26%, while France’s CAC 40 Index gave back 0.66% of its value. In Italy, the FTSE MIB advanced 1.33%. Germany’s DAX climbed 0.42%.

Headline inflation in the eurozone slowed to an annual 6.1% in May from 7.0% in April—below a FactSet consensus estimate of 6.3%. The core rate—which excludes volatile food and fuel prices—came in at 5.3%, which was also an improvement from the prior month and below expectations.

European Central Bank (ECB) President Christine Lagarde reiterated in a speech that inflation was still too high and “it is set to remain so for too long." She added: "That is why we have hiked rates at our fastest pace ever—and we have made clear that we still have ground to cover to bring interest rates to sufficiently restrictive levels." The minutes of the ECB’s May meeting showed most policymakers voted to slow the pace of rate increases to a quarter point. Still, they signaled an appetite to tighten monetary policy further.

Amid continued strong foreign investor interest, Japanese equities rose over the week, with the Nikkei 225 Index rising 1.97% and the broader TOPIX Index up 1.72%. The indexes reached fresh 33-year highs, with the gains supported by strong domestic earnings and yen weakness. The sentiment was also aided by the passage of the U.S. debt ceiling bill and the avoidance of default, as well as some indications that the U.S. Federal Reserve could pause its interest rate hikes in June.

Against this backdrop, the 10-year Japanese government bond yield fell to 0.41% from 0.43% at the end of the previous week. Bank of Japan (BoJ) Governor Kazuo Ueda said it was premature for the central bank to discuss details of an exit from its ultra-easy monetary policy and that there was no set time frame for achieving its 2% inflation target, given uncertainty about the outlook for prices. He emphasized the need for central banks to be more careful about how they communicate.

The yen strengthened to about JPY 139 against the U.S. dollar from the prior week’s JPY 140.66. The Japanese currency had weakened to around a six-month low against the greenback in anticipation of continued monetary policy divergence between Japan and the U.S. This prompted Japan’s top financial authorities to meet and state that they will closely watch currency market moves and respond appropriately as needed, not ruling out any option available if necessary. The government and the BoJ will work even more closely under the central bank’s new leadership in responding to market risks that may hurt Japan’s economy.

Lastly, Chinese equities (also) rose after the U.S. Senate passed legislation to suspend the debt ceiling, removing the risk of a destabilizing U.S. default and reviving investors’ risk appetite. The Shanghai Stock Exchange Index gained 0.55%, while the blue-chip CSI 300 added 0.28% in local currency terms. In Hong Kong, the benchmark Hang Seng Index rose 1.1% after hitting a six-month low earlier in the week, according to Reuters.

China’s official manufacturing Purchasing Managers’ Index (PMI) fell to a below-forecast 48.8 in May from April’s 49.2, marking the second consecutive month of contraction and the lowest reading since December 2022. A reading above 50 represents an expansion from the previous month. Production activity fell into contraction for the first time since January, dragged down by declines in new orders and exports. The nonmanufacturing PMI also eased, falling to a weaker-than-expected 54.5 in May from 56.4 in April. The sector continued to grow but at the slowest pace since China lifted pandemic restrictions in December.

THE WEEK AHEAD

As the United States Senate successfully passed bipartisan legislation to raise the government's debt ceiling, preventing a potentially disastrous default, attention now shifts to the upcoming macroeconomic calendar. New figures are awaited for services PMI, foreign trade, factory orders, and inventory data. The ISM survey for May is expected to reveal a strengthening in service sector growth, reaching its highest level in three months. Investors will be particularly interested in the gauge that measures price pressures, as there are concerns about service-led inflation, which could influence central bankers to adopt a tightening bias. Additionally, the final estimate of the Markit survey is likely to confirm that business activity growth reached its highest point in over a year in May. Moreover, the trade deficit is expected to have widened in April due to a decline in exports and an increase in imports. On the other hand, factory orders are anticipated to rise for the second consecutive month during the same period.

Have a great week.

Stephen Colavito

Chief Investment Officer

This message is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, which is available upon request.