Last Week in Review – May 29, 2023 – from Stephen Colavito

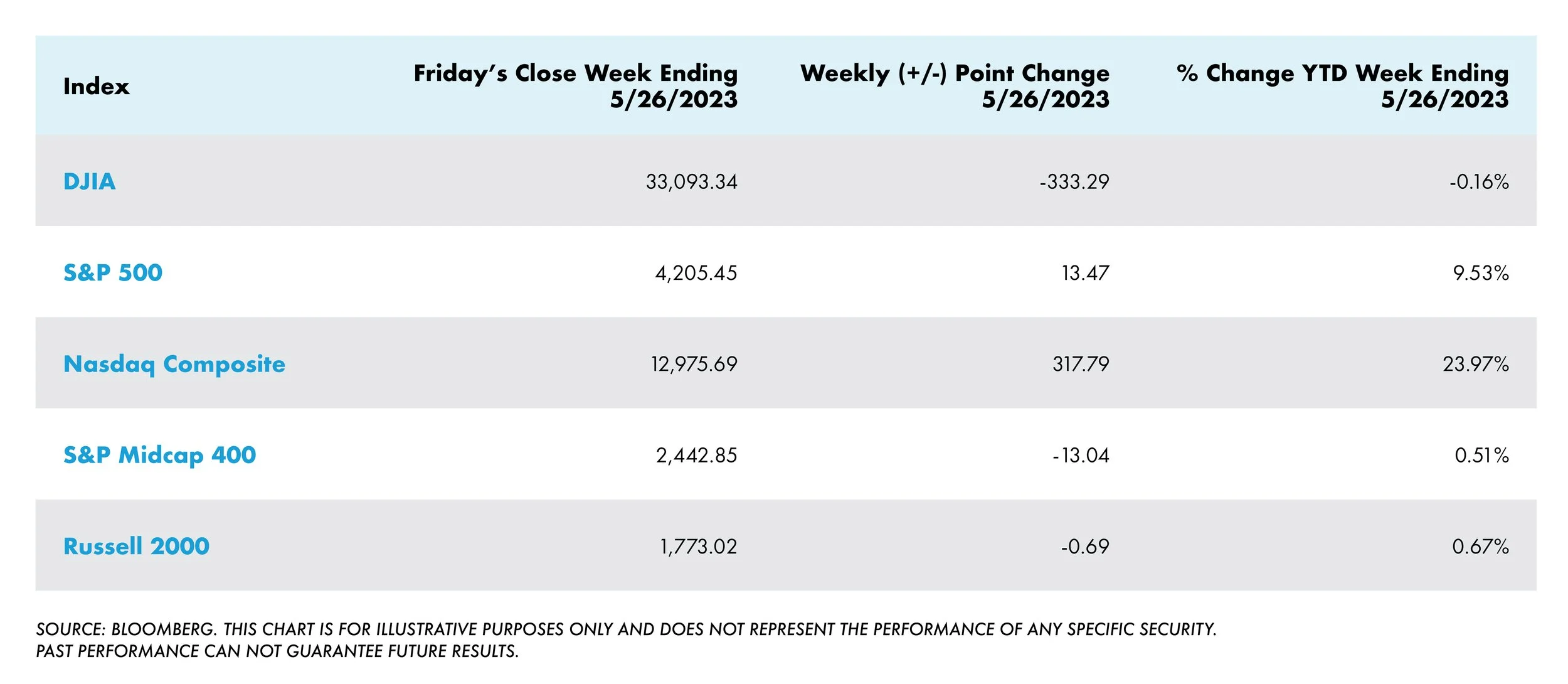

Last week the major equity indexes ended mixed as investors observed signs of progress in negotiations over raising the federal debt ceiling (note: an initial outline is done, and now it is waiting for votes in the House). The technology-heavy Nasdaq Composite outperformed and ended the week up 23.97% for the year-to-date period—starkly contrasting the 0.16% decline of the narrowly focused Dow Jones Industrial Average. Similarly, the Russell 1000 Growth Index ended up 20.75% over the period, while the Russell 1000 Value Index—heavily weighted in the struggling financials sector—was down 1.64%. Markets were scheduled to be closed today, Monday, May 29, in observance of Memorial Day.

Relatedly, alongside the debt ceiling negotiations, the signal event in the week may have been Thursday’s 24% jump in the shares of chipmaker NVIDIA, which took the company’s market capitalization to roughly USD 963 billion by the end of the week and made it the sixth most highly valued public company in the world. Shares rose after the company beat consensus first-quarter earnings expectations by a wide margin and raised its profit outlook. The significant move in such a heavily weighted stock reverberated throughout the major benchmarks.

US - MARKETS & ECONOMY

Some discouraging inflation data may have capped Friday’s gains. The core (less food and energy) personal consumption expenditures (PCE) price index, considered the Federal Reserve’s preferred inflation gauge, rose by 0.4% in April, a tick above expectations. On a year-over-year basis, the index rose by 4.7%, indicating no progress in bringing inflation down since the start of the year. Meanwhile, the Commerce Department reported that personal spending had jumped 0.8% in April, roughly double consensus expectations and supported by increased spending on goods and services.

US – EQUITY MARKET PERFORMANCE

US YIELDS & BONDS

The signs of a resilient consumer and persistent inflation pressures led to a jump in short-term U.S. Treasury yields, with the yield on the two-year note hitting its highest level in over two months. Reflecting debt ceiling worries, the yield on the one-month Treasury bill hit 6.02% at the end of the week, its highest level since its introduction in 2001.

Continued sales of municipal bonds by the Federal Deposit Insurance Corporation (FDIC)—assets acquired following recent bank failures—weighed on the municipal bond market. In the investment-grade corporate bond market, traders we spoke with noted that the front-loaded week of issuance was adequately subscribed to before new issues slowed down as we approached the long weekend, while regional bank issues rebounded.

Meanwhile, the high-yield market saw lower-than-average volumes throughout the week. Commercial mortgage-backed securities outperformed other types of credit, Treasuries, and the broad U.S. high-grade aggregate index. Volumes lightened over the week, but overall supply remained robust and met with solid demand.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth +0.01 bps to 5.23%

2-yr: +0.29 bps to 4.56%

5-yr: +0.20 bps to 3.93%

10-yr: +0.13 bps to 3.80%

30-yr: +0.03 bps to 3.96%

SOURCE: FOR THE WEEK ENDING, May 26, 2023. BLOOMBERG. YIELDS ARE FOR ILLUSTRATIVE PURPOSES ONLY AND DO NOT REPRESENT THE PERFORMANCE OF ANY SPECIFIC SECURITY. YIELD CHANGES ARE FOR ONE WEEK. PAST PERFORMANCE CAN NOT GUARANTEE FUTURE RESULTS.

INTERESTING NEWS OVERSEAS

Shares in Europe fell on signs that the economic outlook may be worsening and continued uncertainty over U.S. debt ceiling talks. The pan-European STOXX Europe 600 Index slid 1.59% in local currency terms. Major stock indexes also weakened. Germany’s DAX declined 1.79%, France’s CAC 40 Index dropped 2.31%, and Italy’s FTSE MIB tumbled 2.93%. The UK’s FTSE 100 Index lost 1.67%.

European government bond yields broadly climbed on concern that central bank policymakers would extend their policy tightening to cope with persistent inflationary pressures. The yield on the benchmark 10-year German government bond settled above 2.5%. Spain’s and Italy’s sovereign bond yields also rose. In the UK, robust core inflation data fueled a broad sell-off in the bond markets, with the yield on the benchmark 10-year UK government bond heading toward 4.3%.

According to official figures, the German economy lapsed into recession in the first quarter. Gross domestic product shrank 0.3% in the three months through March, a downward revision from an early estimate of zero growth that reflected a sizable drop in household consumption. Germany’s economy contracted 0.5% in the final three months of last year. Meanwhile, German companies became more uncertain about the year ahead, with the Ifo Institute’s business confidence index falling in May for the first time in seven months.

European Central Bank (ECB) policymakers echoed ECB President Christine Lagarde’s view that interest rates would need to rise further and stay high to curb inflation in the medium term. Bank of Spain Governor Pablo Hernandez de Cos said policy tightening still had “some way to go” and that “interest rates will have to remain in restrictive territory for an extended period to achieve our objective in a sustained manner over time.” Banque de France Governor Francois Villeroy de Galhau said: “I expect today that we will be at the terminal rate not later than by summer.”

The Nikkei 225 benchmark touched a 33-year high early in the week before finishing just below the 31,000 mark. Upbeat economic data and encouraging signals regarding the U.S. debt ceiling helped propel the Nikkei 225 to its highest close since July 1990. The broader TOPIX index finished the period slightly lower.

Japanese manufacturing activity expanded for the first time in seven months in May. The services sector also reported robust growth, as the return of domestic and international tourism fueled a record rise in business activity. In the afterglow of such strong purchasing managers’ index (PMI) numbers, investors shrugged off data showing that Japan’s core machinery orders fell for a second straight month in March.

Hawkish comments from the Fed during the week added to speculation that U.S. rates will remain higher for longer. Meanwhile, Governor Kazuo Ueda reconfirmed the Bank of Japan’s ultra-loose monetary policy stance until inflation sustainably hits its 2% target. These divergent paths pushed the U.S. dollar to a six-month peak against the Japanese currency, trading in the higher JPY 139 range by Friday’s close.

Lastly, Chinese stocks fell after a batch of disappointing indicators in recent weeks pointed to a flagging economic recovery. According to Bloomberg, the benchmark CSI 300 Index fell 2.4%, its biggest weekly drop since the five days ended March 10, and erased all its gains this year. In Hong Kong, the benchmark Hang Seng Index fell below the psychologically crucial 19,000-point level to its lowest close since December in a holiday-shortened trading week.

No major indicators or policy measures were released in China during the week. But mounting evidence that the country’s post-pandemic recovery is losing momentum has raised concerns about the economic outlook. Most recently, industrial output, retail sales, and fixed asset investment grew at a weaker-than-expected pace in April, while weak credit growth indicators also pointed to sluggish domestic demand.

As expected, Chinese banks kept their one- and five-year loan prime rates steady for the ninth month after the People’s Bank of China (PBOC) left its one-year policy loan rate unchanged earlier in May. However, speculation is growing that the central bank will ease policy to shore up the economy. According to Bloomberg, China’s 10-year government bond yield dropped to a six-month low of 2.70% last week as traders increased their bets on monetary easing by the PBOC in the near term.

Geopolitical risks also dampened risk appetite after Beijing said it would ban Chinese companies from buying products from Micron Technology, citing security risks uncovered in a U.S. chipmaker’s product review. The ban announced on May 21 applies to domestic telecom firms, state-owned banks, and other companies behind China’s information infrastructure. The Chinese ban on Micron was seen as China’s most significant retaliation in response to U.S. controls on certain technology exports.

THE WEEK AHEAD

US futures were higher today (5/29/2023), with contracts on the Dow Jones rising nearly 90 points, the S&P 500 adding 0.4%, and the Nasdaq 100 gaining 0.7% as investors welcomed the highly anticipated debt-ceiling deal. President Biden and House Speaker Kevin McCarthy reached a tentative agreement in a phone call late on Saturday and showed confidence it would pass in Congress. The bill will suspend the debt ceiling until January 1, 2025, and federal spending will be capped for the next two years. US stock and bond markets are closed Monday for the Memorial Day holiday. This week, investors will closely monitor a batch of economic data, including the payrolls report and the ISM Manufacturing PMI. Last week, the Dow lost 1% while the S&P went up 0.3%, and the Nasdaq notched its fifth straight week of wins.

Have a great week.

Stephen Colavito

Chief Investment Officer

This message is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, which is available upon request.