Last Week in Review – June 12, 2023 – from Stephen Colavito

LAST WEEK IN REVIEW

Last week stocks closed modestly higher in relatively subdued trading ahead of the Federal Reserve’s policy meeting and rate announcement. The week was notable for the S&P 500 Index moving into bull market territory, or up more than 20% off its mid-October lows. It was also noteworthy for broadening market gains, with small-caps outperforming large-caps and value shares outperforming growth stocks. An equally weighted S&P 500 Index rose more than its capitalization-weighted counterpart for the first time in eight weeks and by the most significant margin since late March.

Several major investment conferences and events took place during the week, including the Paris Air Show and energy and consumer stocks conferences, which seemed to drive sentiment. Apple’s annual developer’s conference also made headlines as the world’s most valuable public company unveiled its first significant new product in several years, a virtual reality headset. Investors seemed to react negatively to the USD 3,500 price of the device, but the stock recovered some of its losses later in the week. Oil prices rose Monday morning after Saudi Arabia announced a unilateral production cut over the previous weekend but fell back to end the week lower.

US - MARKETS & ECONOMY

Last week’s relatively light economic calendar seemed to support investor sentiment—if not necessarily hopes that the economy would avoid a recession. On Thursday, the Labor Department reported that weekly jobless claims had jumped to 261,000, well above expectations and the highest level since October 2021. However, continuing claims fell back unexpectedly and hit their lowest level in nearly four months. An overall index of economic optimism published by TechnoMetrica Market Intelligence and Investor's Business Daily remained roughly steady. Still, the index’s gauge of Americans’ outlook for the next six months fell to its lowest level since November.

Data released last Tuesday showed a surprisingly large contraction in the services sector. Still, the silver lining for investors was evidence of a continuing decline in services prices, which have remained “sticky” in relation to moderating prices for goods, food, and energy. The Institute for Supply Management’s gauge of prices paid for services moderated to its lowest level since May 2020. Its overall service sector activity fell to 50.3, indicating virtually stalled growth (levels over 50 indicate expansion).

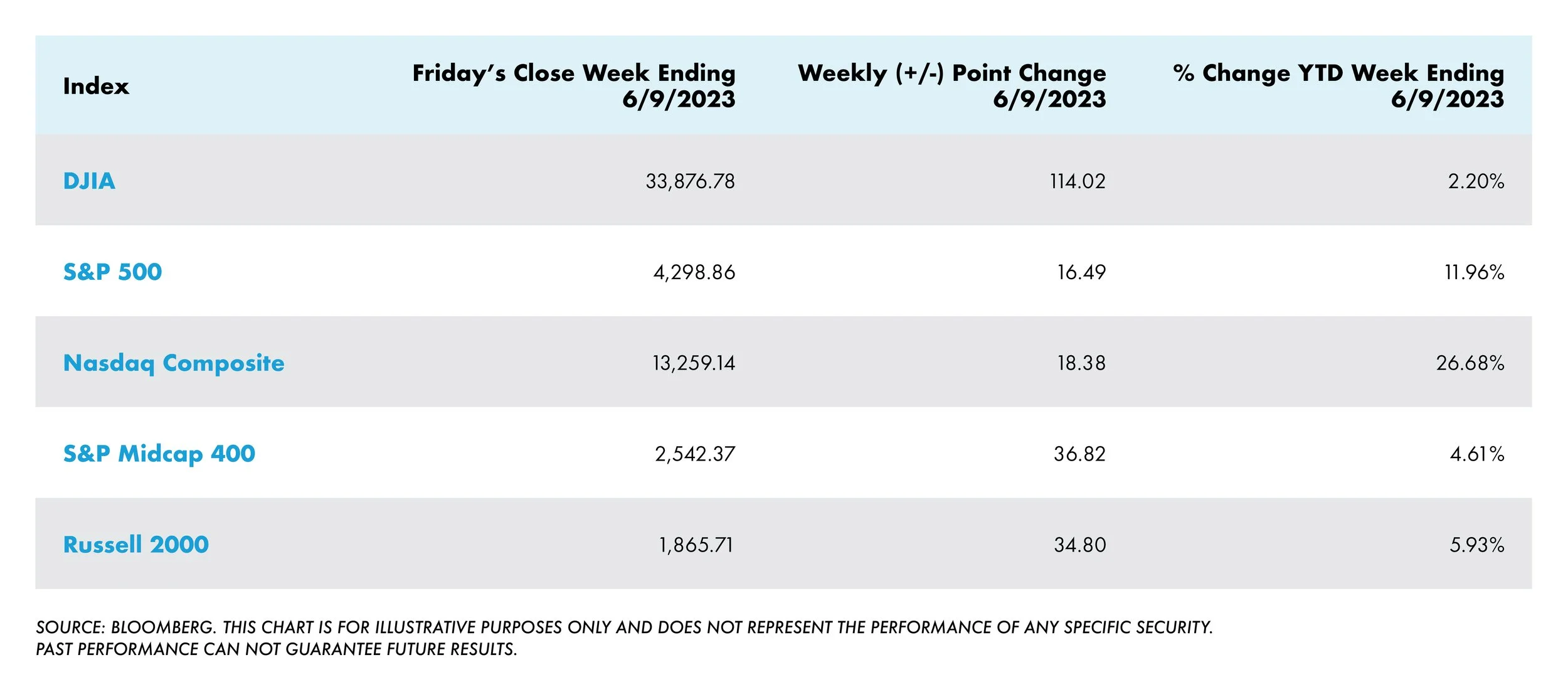

US – EQUITY MARKET PERFORMANCE

US YIELDS & BONDS

Longer-term Treasury yields rose modestly over the week. However, some speculation mounted about how the market would accompany a flood of issuance of short-term bills now that the federal debt ceiling has been raised. Strong summer technicals continued to support tax-exempt municipal bonds. The Federal Deposit Insurance Corporation (FDIC) saw adequate demand for new issues and municipal bond sales. The FDIC is liquidating the Muni bonds it obtained after taking three large regional banks into receivership.

The investment-grade corporate bond market had a front-loaded supply of issuance, followed by a steady influx throughout the week. Total weekly issuance more than doubled expectations but was met with adequate demand. Meanwhile, many high-yield investors reduced exposure to BB-rated bonds while looking to add lower-rated securities with lower dollar prices and higher yields.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth -0.11 bps to 5.24%

2-yr: +0.10 bps to 4.60%

5-yr: +0.07 bps to 3.91%

10-yr: +0.05 bps to 3.74%

30-yr: -0.01 bps to 3.88%

INTERESTING NEWS OVERSEAS

In local currency terms, the pan-European STOXX Europe 600 Index ended 0.46% lower amid caution ahead of central bank meetings in Europe and the U.S. Major stock indexes were mixed. Germany’s DAX eased 0.63%, France’s CAC 40 Index fell 0.79%, and Italy’s FTSE MIB gained 0.35%. The UK’s FTSE 100 Index lost 0.59%.

European Central Bank (ECB) officials signaled that borrowing costs will likely rise again in June, although there appeared to be less unanimity on implementing rate increases in subsequent months.

ECB President Christine Lagarde and Bundesbank chief Joachim Nagel reiterated their hawkish stance for more rate increases, pointing out that there were few signs of easing in underlying price pressures. However, Dutch central bank Governor Klaas Knot appeared to have joined the less hawkish policymakers. While acknowledging that rates would still have to rise, Knot dropped his previous insistence on increases in June and July. He said rate decisions must be taken step by step as there was more evidence that tighter monetary policy was working.

According to an ECB survey, median consumer expectations for eurozone inflation in the year ahead fell in April to 4.1% from 5.0% in March.

Revised data showed that the eurozone economy shrank by 0.1% sequentially in the first quarter of this year and the final three months of 2022, meeting the technical definition of a recession.

Meanwhile, flat eurozone retail sales in April indicated that consumption remained weak. Germany’s industrial sector also continued to deteriorate. Factory orders unexpectedly fell 0.4% compared with March, while industrial output grew 0.3% sequentially—less than the 0.5% uptick expected by economists polled by FactSet.

Japan’s stock markets rose over the week, reaching fresh 33-year highs, with the Nikkei 225 Index gaining 2.4% and the broader TOPIX Index up 1.9%. The sentiment was supported by an upward revision to Japan’s first-quarter economic growth because of more robust corporate investment and hopes that the services sector—which could benefit from rebounding foreign inbound tourism—will drive further expansion.

The yen remained close to a six-month low against the U.S. dollar, trading in the higher JPY 139 range, as the ongoing monetary policy divergence between the dovish Bank of Japan (BoJ) and the other major central banks, which largely remain in tightening mode, weighed on the Japanese currency. The weak yen continued to benefit Japan’s exporters and boost the attractiveness of local assets to foreign investors.

The yield on the 10-year Japanese government bond rose to 0.43% from 0.41% at the end of the previous week. The yield was broadly range-bound ahead of the BoJ’s June 15–16 monetary policy meeting. Expectations that the central bank will again tweak its yield curve control framework have fallen to some degree as BoJ Governor Kazuo Ueda has repeatedly stated that the central bank will patiently continue with monetary easing until it achieves its 2% price stability target sustainably and stably, accompanied by wage increases. During the week, he said there is still some distance to achieving that target and uncertainty surrounding the inflation outlook.

Lastly, Chinese equities were mixed after the latest inflation data increased concerns about the country’s faltering post-pandemic recovery. The Shanghai Stock Exchange Index rose 0.04%, while the blue-chip CSI 300 declined 0.65% in local currency terms. In Hong Kong, the benchmark Hang Seng Index gained 2.32%, extending the previous week’s gains.

May inflation figures pointed to rising deflation risks weighing on China’s economy, dealing with weak domestic and overseas demand, a sluggish property market, and high youth unemployment. China’s consumer price index rose 0.2% in May from a year earlier, compared with April’s 0.1% expansion, a 26-month low. Core inflation, which excludes volatile food and energy prices, slowed to 0.6% from the previous month’s 0.7%. The producer price index fell a worse-than-expected 4.6%, accelerating from a 3.6% decline in April, and marked the weakest reading since May 2020.

THE WEEK AHEAD

It will be a very eventful week in the United States, with a central focus on the FOMC announcement on June 14th and updated economic projections from the FOMC. The market is currently pricing in a 77% chance that the Fed would maintain its interest rates at the current levels, but the inflation rate released a day before may change those projections. The US inflation rate is forecasted to fall to 4.1% in May from 4.9% in April, while the core gauge may decelerate to 5.2% from 5.5%. On the other hand, retail sales are expected to fall by 0.1%. The other essential reports cover producer and foreign trade prices, industrial production, the preliminary estimate of Michigan Consumer Sentiment, overall capital flows, business inventories, and the government's monthly budget numbers for May. Regional activity indexes such as the Philadelphia Fed Manufacturing Index and NY Empire State Manufacturing Index will also be spotlighted.

Stephen Colavito

Chief Investment Officer

This message is provided for informational purposes and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, which is available upon request.