The Weekly Random Walk – June 12, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

FOMO

Fear of missing out (FoMo) is a unique term introduced to describe a phenomenon observed on social networking sites. It has now moved to markets where the perception of missing out means the flow of funds into specific sectors or stocks. These flows push those stocks (indexes) higher, creating even more FoMo.

Welcome to investing in 2023.

This week we are looking at a market chasing higher valuations as the economy shows signs of slowing and inflation remaining sticky (aka, early signs of stagflation).

The Market Is Very Narrow

Although the market started to broaden slightly this week, the S&P 500 continued to a new year-to-date high of 4298.86 as the debt limit conflict was resolved. Ten percent of the just under twelve percent year-to-date performance has been driven by the seven (just 7) large-cap names amidst the AI euphoria. Hedge funds still have low net positioning to equities and are underperforming, while less than 30% of large-cap mutual funds are beating their index this year. The pain trade appears to continue to push equities higher (for now).

More Greed, Less Fear

CNN has a Fear & Greed Index that is a way to gauge stock market movements and whether stocks are reasonably priced. It is a compilation of different indicators that measure stock market behavior. Market momentum, stock price strength, price breadth, etc. Markets can become oversold and overbought; we are in an overbought scenario.

How Low Can You Go?

With markets hitting YTD highs and the debt ceiling in the rearview mirror, investors are embracing the narrative that the Fed is near the end of a tightening cycle. At 13.83, the VIX is at (low) levels not seen since before the pandemic. Fear has left the market. Similarly, implied volatility in the credit markets suggests investors believe another economic or geopolitical shock is not a near-term risk. Both markets continue to see unwinds of left-tail protection strategies.

Don’t Worry, Be Happy

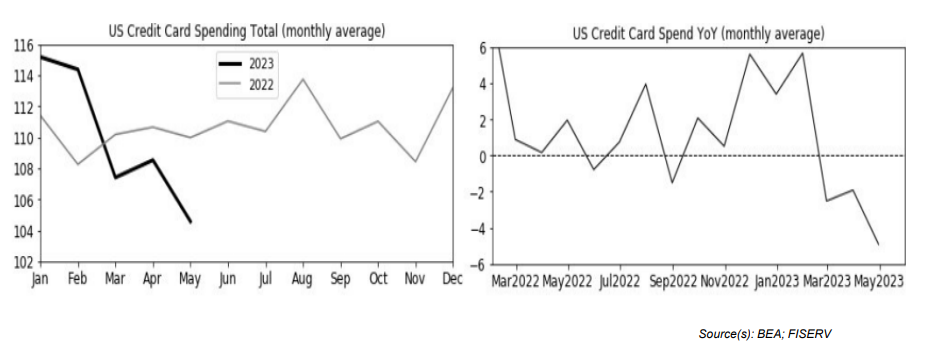

The market is anticipating higher-than-expected 2023 EPS (earnings per share) to drive valuations, but one has to wonder where the optimism comes from. The data compiled by the BEA and credit card intermediary FISERV, and developed by the Fed, shows a broad-based decline in card spending in 2023 (through the end of May) both in absolute terms and compared to 2022. Spending in restaurants and bars remains the only sector where spending is running higher than in 2022 on a YTD comparison.

Jumbo Box of Toilet Paper, Please

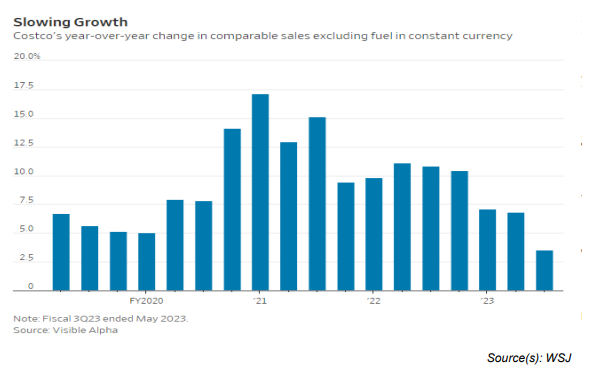

Even though we always walk out with a cart full of things we don’t need, Costco reported another slowing in sales that aligned with retail stocks' bludgeoning. Those are now down to the low single digits year-over-year from over 15% in 2021. In addition, the company’s earnings call mentioned consumers downshifting from higher-priced items to Costco’s generic Kirkland brand (no wonder that TP we bought feels like sandpaper).

Buying a Home Gets Harder

Thirty-year mortgage rates are rising again, helping push the average monthly mortgage payment in the US to $3000. This is a significant increase from the average payment of $1400 just a few years ago. The rising cost of housing is putting a strain on many American families, which most economists expect to eventually impact consumer spending.

Bank Money Is Also Getting Tighter

Money continues to flow out of banks (except if you’re JPM, BoA, or Wells), moving into money market funds and treasuries. The Fed continues to use its emergency bank funding facility (which now tops 100 billion for the first time). Yet, somehow regional bank stocks have been up for the fourth straight week as they ignore ongoing real (NSA) deposit outflows.

So as the flow of cash moves out of regional banks, they are only extending loans very sparingly (this was highlighted in a speech by Dall Fed President Robert Kaplan a week ago).

To survive, leadership at small and midsized banks is considering how to shrink their loan books to address the mark-to-market capital loss and guard against continued deposit instability. Considering that small and midsized banks are the grassroots of consumer and small business lending, this could signify a massive slowdown in economic activity.

Back To the Taylor Rule

We sound like a broken record on the Taylor Rule, but it continues to be applicable in looking at where the Fed may need to go with rates. As the labor market continues to stay robust, the Fed may be forced to tighten again after what we suspect will be a pause this month.

The chart below shows the Fed’s benchmark rate juxtaposed against a more generous application of the Taylor Rule and a less generous interpretation. The more generous version is derived from the Dallas Fed, trimmed mean PCE, and assumes a -50 bps real policy rate. The less generous version is based on current inflation and a higher real rate of +50 bps real return that is more consistent with the macroeconomic momentum seen after 2020.

Core PCE remains high and well above the Fed’s year-end estimate of 3.6%. Even though the Fed has raised rates by 500 bps (5%) in the current rate hiking cycle, core PCE has only come down by 70 bps from its peak of 5.4%.

Fed futures and rate traders have yet to fully wake up to the possibility that the Fed will have to raise rates again. Equities haven’t woken up to the fact that rates will have to stay higher for longer, so at what point does the FoMo become WTH? We wonder.

Bullets

In an “oh boy” moment, two of San Francisco’s most prominent hotels – Hilton San Francisco Union Square and Parc 55 – have stopped mortgage payments and plan to give up the two properties. This comes on the back of retailers in the city shutting their doors due to excessive crime rates and the highest commercial vacancy rate of any major city (at 30%). Having spent much time in that city over the last few years, we have seen the declines, and massive leadership change is needed.

San Francisco is not alone in commercial real estate issues, as stress is felt in major US cities. According to real estate data firm Trepp, more than 4% of office loans packed into commercial mortgage-backed securities were delinquent in the last 30 days (at the end of May), the highest level since 2018. Consider this a warning because we suspect this is the tip of the iceberg for delinquencies, as 35 billion in CMBS office loans are scheduled to mature by the end of 2023, and the refinancing market is effectively shut down to this asset class.

Data released this week shows that the BRICs countries, led by China, continue to amass a considerable amount of physical gold as all have expanded their reserves for the seventh straight month. Last week it was announced that China bought an additional 16 tons of bullion, and they continue encouraging Chinese investors to do the same.

Lastly, we hold to our position and agree with the CNN fear/greed indication that this market is overbought. We suspected this could be in the cards two weeks ago after the debt ceiling problems were removed from the market lexicon. But FoMo has taken things too far and fast, and we continue to think raising a little cash at these levels is prudent for traders. Economic headwinds are blowing, but please understand that we never recommend making an “all-in or all-out” bet, but small tactical allocations can be suitable in these markets.

There will be no update next week. We are in DC and then spending some time with family. We will see you in a few weeks.

As always, be careful and trade well.

Stephen Colavito, CIO

San Blas Securities

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.