Last Week in Review – December 11, 2023 – from Stephen Colavito

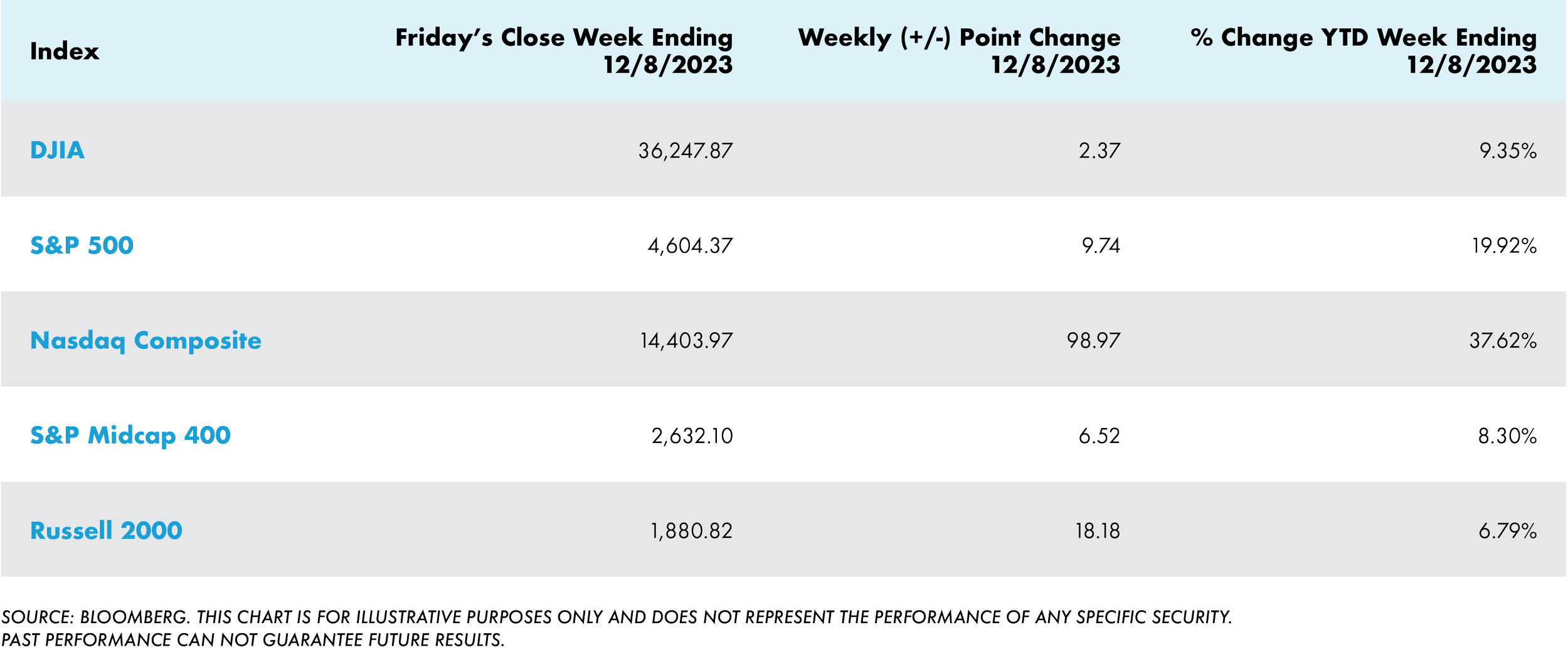

A late rally helped the major indexes end flat to modestly higher last week. The small-cap Russell 2000 Index outperformed the S&P 500 Index for the third time in the past four weeks, helping narrow its significant underperformance for the year-to-date period. Growth stocks built modestly on their lead over value shares, however. Within the S&P 500, energy stocks lagged as domestic oil prices fell below USD 70 per barrel for the first time since June.

Continuing enthusiasm over the potential of generative artificial intelligence (AI) boosted the growth indexes and the technology-heavy Nasdaq Composite. Shares of Google parent Alphabet rose over 5% on Thursday after the company revealed its new AI model, Gemini, which can process text, code, audio, images, and video and can be incorporated into mobile applications. Meanwhile, Advanced Micro Devices rose nearly 10% when it announced the launch of a new generation of AI chips. Earlier in the week, Apple again eclipsed USD 3 trillion in market capitalization and moved back near its summer all-time highs.

US - MARKETS & ECONOMY

Last week’s busy economic calendar seemed to be another major driver of sentiment. Friday’s closely watched nonfarm payrolls report surprised modestly on the upside, with employers adding 199,000 jobs in November versus consensus expectations of around 180,000. The unemployment rate also surprised by falling back to 3.7% from a two-year high of 3.9% in October. Average hourly earnings rose 0.4%, above expectations, but the year-over-year increase remained at a consensus 4.0%.

The bigger surprise—and the more significant market reaction—seemed to be the University of Michigan’s preliminary gauge of consumer sentiment in December, which jumped to its highest level since August on calming inflation fears. Survey respondents expected prices to increase by 3.1% in the coming year, down sharply from 4.5% in November and the lowest rate since March 2021. Gauges of consumer expectations and their assessment of current economic conditions also rose considerably.

The rest of the week’s economic data were mixed. On Tuesday, S&P Global and the Institute for Supply Management data showed a modest pickup in services sector activity in November. Still, the Labor Department’s count of October job openings fell much more than expected to 8.73 million, the lowest level since March 2021. October factory orders, reported on Monday, also fell more than expected.

US YIELDS & BONDS

The data on job openings, in particular, seemed to drive a continued decrease in long-term interest rates over much of last week, with the yield on the benchmark 10-year U.S. Treasury note hitting an intraday low of 4.10% on Thursday. Yields rebounded in the wake of the payrolls report, however. Technical conditions continued to support tax-exempt municipal bonds. Specifically, manageable supply and coupon payments—a source of reinvestment cash—contributed to the positive technical backdrop.

The investment-grade corporate bond market weakened relative to Treasuries among softer tones at the beginning of the week. Issuance came in slightly above expectations, and about half of the issues were oversubscribed. High-yield bond investors focused mainly on the very active primary market as companies looked to refinance debt or issue new deals before year-end. Demand was robust for BB-rated bonds with attractive coupons. The bank loan market maintained its firm tone as investors focused on the primary market, which saw a flurry of refinancing and repricing transactions.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth +0.02 bps to 5.37%

2-yr: +0.18 bps to 4.72%

5-yr: -0.25 bps to 4.24%

10-yr: +0.03 bps to 4.23%

30-yr: -0.09 bps to 4.30%

INTERESTING NEWS OVERSEAS

The pan-European STOXX Europe 600 Index advanced for a fourth consecutive week, ending 1.30% higher in local currency terms. Stocks appeared to receive a lift from expectations that central banks could cut interest rates next year due to slowing inflation and signs that European economies have been faltering. Major stock indexes rose as well. France’s CAC 40 Index climbed 2.46%, Germany’s DAX gained 2.21%, and Italy’s FTSE MIB added 1.59%. The UK’s FTSE 100 Index tacked on 0.33%.

European government bond yields broadly ended lower as comments by some European Central Bank (ECB) policymakers fueled hopes that rate reductions could come sometime in the first half of 2024. The benchmark 10-year German bond yield slid toward its lowest levels this year. Italian government bond yields also declined. In the UK, the 10-year government bond yield fell to below 4% for the first time since mid-May on expectations that the Bank of England could start cutting borrowing costs by mid-2024.

In an interview with Reuters, ECB Executive Board member Isabel Schnabel signaled a shift to a dovish stance, saying, “The most recent inflation number has made a further rate increase rather unlikely.” Inflation has slowed sharply for three months to just above the ECB’s 2% target. Schnabel, the first policy hawk to change her view, also warned—as have other policymakers—that the fight against inflation is not over and that prices may rise again as budget subsidies expire. High energy prices fall out of annual comparisons. Meanwhile, Governing Council member Francois Villeroy de Galhau told a French newspaper that disinflation happened more quickly than previously. “This is why, barring any shocks, there will not be any new rise in rates. The question of a rate cut could arise in 2024, but not right now,” he said.

Japan’s stock markets lost ground over the week, with the Nikkei 225 Index falling 3.4% and the broader TOPIX Index down 2.4%. Comments by Bank of Japan (BoJ) officials stoked speculation that the central bank may abandon its policy of negative interest rates earlier than anticipated, weighing on riskier assets. Equities came under further pressure as data showed that Japan’s economy contracted by more than initially estimated in the third quarter of the year.

Amid perceived BoJ hawkishness, the 10-year Japanese government bond (JGB) yield rose to 0.77% from 0.71% at the end of the previous week. A notably weaker-than-expected 30-year JGB auction was another factor that pushed yields higher.

Growing speculation about BoJ policy normalization saw the yen strengthen to the low-144 level against the U.S. dollar, its highest in nearly four months, from about 146.8 at the end of the prior week. The Japanese currency also gained in anticipation of reduced interest rate differentials with the U.S., where market consensus appears to be converging around the view that the Federal Reserve is done with raising rates for now.

Lastly, Chinese equities fell after a credit downgrade on China’s sovereign debt by Moody’s underscored worries about its economic outlook. The Shanghai Composite Index declined 2.05%, while the blue-chip CSI 300 gave up 2.4% after falling midweek to its lowest level in nearly five years. According to FactSet, the Hang Seng Index fell 2.95% in Hong Kong.

Moody’s cut its outlook for China’s government bonds to "negative" from "stable" on Tuesday, saying that the country’s debt-laden local governments and state firms posed downside economic risks. The ratings cut from the U.S. credit agency was the latest setback for financial markets in China, grappling with a yearslong property market downturn and flagging consumer and business confidence. In response, Beijing issued a flurry of pro-growth measures this year to shore up demand, although analysts say the measures have been insufficient to revive the economy.

THE WEEK AHEAD

This week, all attention will be directed toward the Federal Reserve’s final policy meeting in 2023. US policymakers are expected to maintain interest rates at a 22-year high, prompting investors to closely analyze the Fed's statement and Chair Jerome Powell's press conference for any hints regarding potential rate cuts in 2024. The US will also release critical inflation data, including consumer, producer, and foreign trade prices. Consumer prices are predicted to have inched up by 0.1% in November after staying unchanged in October, while the core rate is expected to have advanced by 0.2%, mirroring the previous month's pace. At the same time, retail sales are anticipated to decline for the second consecutive month by 0.1%, while industrial activity is poised to rebound by 0.3%, following a 0.6% contraction in October. Other critical data are flash S&P Global PMI surveys and monthly budget statements.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

This message is informational and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, available upon request.