The Weekly Random Walk – December 11, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Don’t Stop Believin’

Yes, we are going into the “way back machine” to 1981 when Journey released the second single from the group’s seventh studio album Escape In our humble opinion, this is one of the most iconic songs from our high school days, and the way we know this is our kids know the lyrics to this song in 2023.

Wall Street and investors seem to believe that either a soft or no landing scenario will come to pass, propelling the Fed to cut rates back to levels that give investors little choice but to buy equities (T.I.N.A. – there is no alternative). But we are thinking in 2024, it may be more like;

“Some will win, some will lose

Some are born to sing the blues

Whoa, the movie never ends

It goes on and on and on and on

Don’t Stop Believin’”

Rate Cut Expectations

Over the last few weeks, Central Bankers have suggested that if inflation continues to moderate for several more months, the Fed may be able to lower the policy rate in “three to five months.” This, combined with France Governor Villeroy's suggestion that ECB rate hikes were done, led to an acceleration in market timing for rate cuts by both Fed and ECB projections, with potential cuts priced in as early as Q1 2024.

Inflation

The reason Fed officials have been optimistic about potential rate cuts is highlighted in the table below, which shows the recent slowing in various measures of PCE inflation. The one-month annualized rate in November was below 2% for most measures. The six-month annualized rate (which Chairman Powell highlighted in his comments a few weeks ago) has slowed to 2.5% from 4.5% six months ago. The Fed’s Q4 2024 Core PCE inflation forecast is 2.6%.

What this chart does not show is a potential reacceleration in inflation in Q1 for two reasons: 1) consumer spending is showing a little slowdown, and 2) even if everything was flat, the year-over-year and quarter-over-quarter comps in Q1 are likely going to show a pickup. If (this is a big “if”) oil prices stay below $75 a barrel, those lower comps may help to offset. Only time will tell.

Yields Are Making Believers Of Markets

Weaker economic data and a dovish Fed helped shift sentiment in the bond market and trigger a rally in bond yields over the last four weeks. The five-year Treasury yields rallied 50 bps from their highs in November to close at 4.24% last Friday. Investor sentiment and positioning in the bond market have turned predominantly negative to exceptionally positive.

Equities Too

Lower bond yields have helped fuel the jump in the S&P 500 in November in a “bad news is good news” market environment. The summer rally in stocks coincided with more robust complex economic data as investors rejoiced in the lack of spillover effects from the March banking crisis. During that period, good news for the economy meant good news for stocks. However, the market seeks weaker economic data to embrace today's “soft landing” or “Fed easing” scenario.

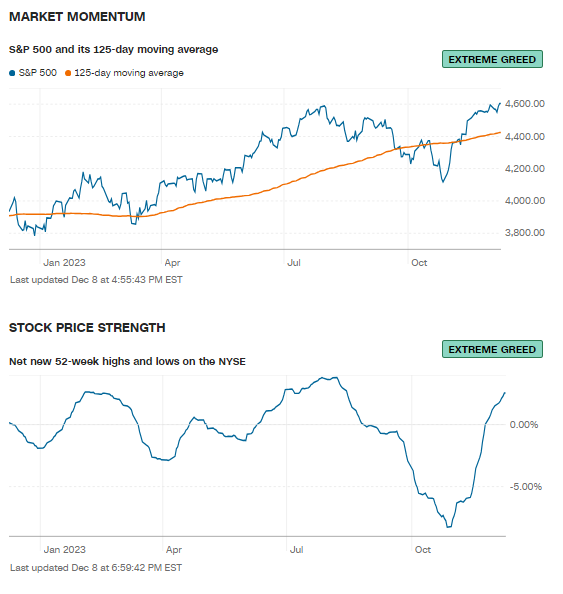

Many investors believe the soft landing will play out as recent market momentum, stock price strength, price breadth, and put/call options are all in extreme greed as of Friday, 12/8/2023.

Some Will Win, and Some Will Lose

Janet Yellen and the Financial Stability Oversight Council want us to believe that climate change and unregulated non-bank financial institutions are the biggest threats to financial stability. This is their straw man because they know there are 1.3 trillion unrealized interest rate-related losses in the regulated banking system that they don’t want you to know about.

The American Enterprise Institute estimates about 548 billion in losses on bank-owned securities and about 726 billion in interest rate-driven losses on bank loan and lease portfolios. In context, if these unrealized interest rate losses were realized, they would consume more than half of the banking system's 2.3 trillion in equity capital. That’s right…half! Considering these factors, the banking system is not nearly as well capitalized as our Treasury Secretary would claim, so instead, she is having us all focus on the weather.

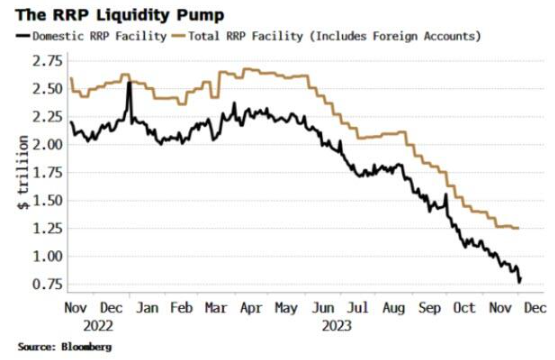

Taking this one step further, this year, the Federal Reserve’s Reverse Repo (RRP) facility has been a critical support system for banks (and equity and bond liquidity). As it approaches zero, banks and markets face much less benign conditions as a formidable tailwind is extinguished.

The RRP peaked at over 2.5 trillion in May after two banks failed earlier in the year. That’s a lot of cash added to the system, but now it’s falling steadily, down more than half from its peak. We ask ourselves, “What happens if/when it goes to zero?”

Not to get too technical, but the Treasury can use the RRP to fund the deficit because MMFs can buy bills and are incentivized to do so as their yield rises above the RRP rate. However, if the RRP goes to zero, government funding of the deficit will be functionally no different than if it has issued primarily longer-term debt (which means higher Government funding rates). Bank deposits and reserves would likely fall more as people move to MMF (money market funds).

We continue to talk about the debt spiral we see as the beginning stages of development. This is one of the catalysts on the short end of the yield curve.

Some Are Born To Sing the Blues

Last week, it was reported that inflows to MMFs continue to be huge (290 billion in six weeks), and more importantly, regional banks' usage of the Fed’s BTFP bailout facility surged to a new record high (even as regional bank stocks surged).

The divergence between soaring MMF and bank deposits continues to widen, and the cost of capital for banks continues to increase even though Treasury rates have come down. This compresses the banks' margins and will keep lending rates “higher for longer” as regional banks desperately try to find profitability in their lending book.

Whoa, The Movie Never Ends, It Goes On and On and On

It seems pretty clear the equity markets are feeling more emboldened than ever. Equity investors (general statement) feel entitled to create any narrative they want for why equities should be up. We are not hating this market; we are just calling balls and strikes. Equities move higher when softer data comes in because investors think the Fed will have to cut rates. No recession, soft landing.

But on Friday, we got employment data showing that things are hotter than the Fed would like, and the unemployment rate remains at 3.7%. Last week, the bond market moved higher, yet equities shrugged off the “good news is bad news” and continued their upward march. No recession, no inflation, low rates…Goldilocks!

Our thesis (and will continue to be) is that markets have moved higher on low rates, low inflation, and high liquidity (Washington printing money). But what happens to economies and markets when one of those elements is removed?

Throughout history, deficit spending and lack of monetary discipline have leveled some of the greatest empires in human history. As we continue the post-Lehman crisis, the OMB estimates that deficits will continue north of a trillion dollars into 2030. If that is the case, there are only two ways to get out of a debt hole:

A) Debt jubilee until default

B) Inflate your way out

Equities are having their cake, and they are eating it too. However, we believe the idea of rate cuts as early as Q1 is overly optimistic and could disappoint equity investors early next year. We love this rally (like the green on our screens) but urge investors to rebalance, stay vigilant, and expect more volatility in 2024. Higher levels of inflation are not going away anytime soon.

This and That

We are not trying to be doom and gloom or remotely political (although it’s been raining all weekend, and quite frankly, it’s depressing; plus, Navy lost to Army, so the weekend is forgettable). But when we read things like Congress providing 7.5 billion dollars for EV charging stations, yet not a single one has been built, we wonder about leadership and accountability. Next year will be interesting, as voters have little in the way of a worthy choice for the Executive Branch unless they vote for third-party candidates in mass (which is unlikely).

This leads us to forecast that 2024 will be bumpy for equity markets. First, we don’t buy the narrative of a soft landing. We believe a moderate recession will take hold, and deflationary pressures will seep into the economy. This will give equities a reason to pause and the VIX to move back into the lower 20s. So, enjoy the rally in December and rebalance in January.

Like the band Journey sings, “Some will win, and some will lose.” – we may see active management in equities have a better year than general indexes for the simple reason that companies that have earnings power in an economic slowdown will shine.

Lastly, our call on a recession would help rates be lower next year than they are today. We remain fixed-income buyers and target our duration in the 5-6 year range. However, when we look out for 18-24 months, we believe yields will increase as government debt becomes more of an issue, and we see foreign buyers shy away from our debt.

We will have one more update before year-end. We wish our friends a very Happy Hanukkah.

Trade carefully. Thank you for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.