The Weekly Random Walk – August 7, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Con.trar.i.an

Noun

—A person who opposes or rejects popular opinion, especially in stock exchange dealing.

They say that recognition is the first sign of recovery. We recognize that we tend to be contrarian; however, like an addictive drug, the data keeps us from meeting with other contrarians at a church in a circle and talking about our 12 steps to recovery (“This is my third week of being positive”).

After reviewing the data this week, if you think we are wrong, invite us to lunch and bring our family for an intervention. At this point, we hold to our conviction that something is not right, and the equity market, driven by liquidity, is overly optimistic about a soft landing.

Gumby

Notice we didn’t use the drug analogy and say “gummies” (you’re welcome). Like, Gumby, equity positioning looks stretched. Most of the equity posting is overweight, with volatility control funds close to their maximum historical weight of 75% and CTAs (commodity trading advisors) at their highest long positioning since February 2020. This is happening while discretionary investors have been reluctant to reduce their long positions (so they maintain an overweighting to equities). The only sign investors are starting to think about “overvalued” is a material drop in sentiment and call buying.

More Evidence

Regarding the market, corporate profits are one of the best indicators of economic strength. Historically detaching the stock market from underlying profitability indicates poor future outcomes for investors. But markets can indeed “remain irrational longer than logic would predict.” But such detachments (historically) have mean-reverted.

Lance Roberts put this chart out last week that shows that when looking at inflation-adjusted profit margins as a percentage of inflation-adjusted GDP, you’ll see a process of mean-reverting activity over time. It shouldn’t surprise you that these events coincide with recessions, crises, or bear markets.

That Looks A Little Steep For A Soft Landing

If you want to “grease” a landing as a pilot, your angle of attack is generally 3 degrees. For ILS (instrument landing systems), a 3-degree to the horizon gives an aircraft a descent rate of approximately 500 feet per minute. Smooth like butter.

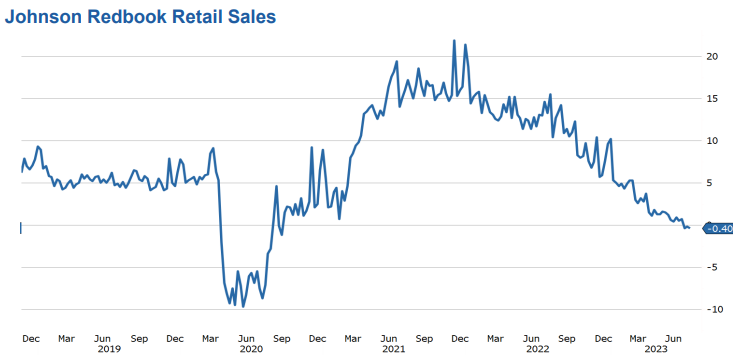

Looking at the recent economic data and the slope of “descent” in retail sales, this landing is more like a “slap it on the runway” or like you’re landing at Midway Airport (if you’ve landed at Midway, you know what I am talking about).

Store sales fell 0.4% compared to last year's period, turning negative for the first time since the pandemic. Retailers blamed it on the heat (with a pitch of climate change) instead of discussing the more significant issue: higher borrowing rates, higher debt balances, and increasing delinquency rates on credit cards. This, along with the increasing theft (unprosecuted in some cities), is putting pressure on revenues and margins for retail stocks.

Luxury Too

Generally speaking, luxury items are resistant to price depreciation or slowdowns. But last week, the owner of Cartier and Van Cleef & Arpels jewelry reported a surprise drop in revenue in the second quarter of this year.

LVMH reported that the US luxury market is souring as the consumer is overleveraged in revolving debt. Considering these factors, it makes sense why diamond prices have collapsed to pre-Covid levels. The latest data from the diamond index shows the index was at 116.12 on August 1st, breaching the floor of 116.26 set on March 2020.

The secondary market continues to slide for those in the luxury watch market. The Bloomberg Subdial Watch Index, which tracks the 50 most traded watches by value on the secondary market, breached its six-month support level of around $35,762. This index has dropped 41% since peaking at about $60,600 in March 2020.

This pains us because we genuinely thought that with the massive appreciation in watches last year, we could retire by the end of this one. Our plastic Timex is a masterpiece, and I had planned on buying that sailboat with that watch. Oh well, we keep working for a little while.

Nothing To See Here, Either

We have many friends in real estate, so we found this to be a very odd development. There are now more employed realtors than there are existing homes for sale. The price appreciation of the existing housing stock can maintain this dynamic (or location, location, location). Otherwise, it appears to be an unstable equilibrium.

Financial Conditions Are (Finally) Getting Tighter

With the rating downgrade by the rating agency Fitch last Tuesday, the 30-year treasury yield cleared numerous resistance points last week. Now well above 4% and climbing to year-to-date highs, this will impact consumer credit more than the shorter part of the yield curve.

Adding to that, the US dollar index continues to decline, and we are now seeing credit conditions finally starting to slow. What concerns us is that retail sales are slowing long before this yield break last week, so a continued slowdown is likely (and may even accelerate).

The Clampetts Are Happy

Those old enough to remember The Beverly Hillbillies will get a laugh at that title. Others will have to search on YouTube to get the joke.

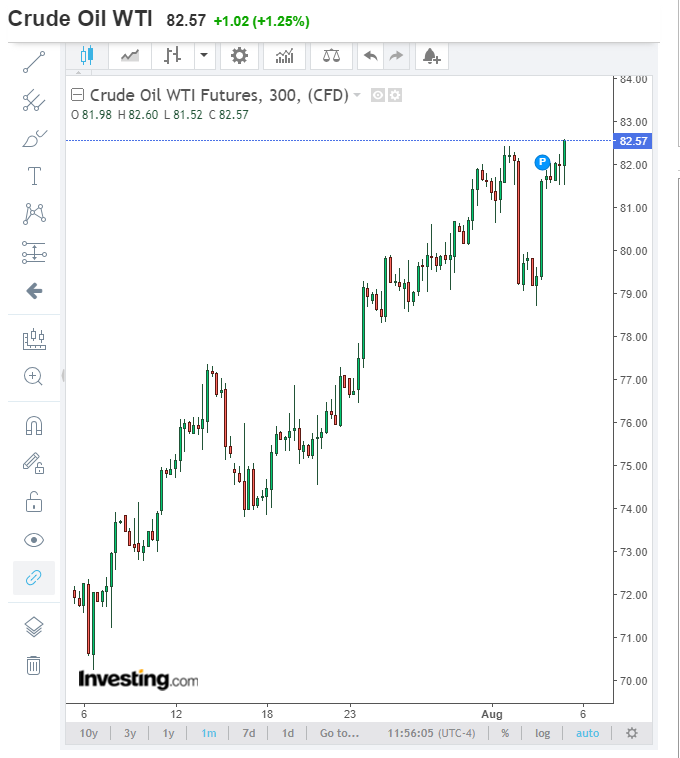

As we predicted, oil continues to climb higher as the administration has little room to add supply via the SPR (more on that in the bullet points). So just like monetary conditions, with cuts from OPEC+, the oil supply side is tightening, and prices are now being felt at the pump.

We suspect that CPI will reflect this jump in September numbers (not this month), and we could see a slight tick higher in inflation. Some are predicting that prices will move up to the $85-90 range; if so, that will have a real impact across the spectrum of CPI components.

The chart below reflects the one-month increase in WTI prices. “The Clampetts did that!”

How Much For That Burger?

Even before we see oil prices affect various CPI components, the Food and Agriculture Organization of the United Nations (FAO) reported on Friday that the global food index, which tracks monthly changes in the international price of globally-traded food commodities average of 123.9 in July, up 1.3% from the previous month.

This is the most significant monthly increase in almost two years as trade, regulation, and weather disruptions increase the cost of staple food items (rice, grains, vegetable, vegetable oil, etc.).

We just went to the grocery store, and it’s the first time we have seen a bill over $300. Inflation is real, and costs continue to climb. If energy prices increase, expect these prices only to go higher.

12-Step Program (in only five bullet points)!

The volatility index (VIX) jumped from 12.91 to 17.1 (an increase of 32%). Not surprising given that August tends to have higher volatility and with equities overbought. We have prognosticated a shift from low to higher volatility for several weeks.

In talking with market makers at some of the larger wirehouses this week, we discussed the interesting tug-of-war between the bulls and bears. The (equity) market is unbalanced; shorts were covered several weeks ago, and now the market is tilted to the long side. So as the S&P 500 got close to 4600, quantitative traders sold as resistance was challenging to break. Since most of the shorts had already been covered, there were minimal bids, and the S&P 500 index moved back down to 4478.03.

Last week, even perma-bulls discussed a market correction in the coming weeks. Yes, we have seen price targets on the S&P 500 being raised (Citi raised theirs to 4600, and Oppenheimer raised theirs to 4900 – the highest on the street), but this market appears tired and, as we continue to repeat, well overbought.

This week, the Biden administration announced they were canceling their planned acquisition of six million barrels of oil to help refill the Strategic Petroleum Reserve (SPR). This move now leaves the US with only 18 days of supply and the lowest level in four decades, as global oil prices have ticked upward after additional cuts in output from Saudi Arabia. Since there is no love loss between the Kingdom and the Biden administration, we wouldn’t be surprised if the Kingdom doesn’t put additional pressure on markets moving levels back above $85 (note: the Biden administration sold 180 million barrels out of the SPR, but that game is now up, and MBS knows it).

Lastly, money markets continue to see record-high inflows, surpassing 5.15 trillion dollars. According to Bloomberg, much of this money continued to come from bank deposits from smaller and midsized banks. We leave you with this final thought: small banks will be in trouble in seven months if nothing changes. They will need to find at least 100 billion in new deposits from somewhere, as that is when the BTFP bailout program ends (unless the Fed extends it). With the cost of capital continuing to grow by the day for smaller banks, we would not be surprised if another round of consolidation happened in this sector.

OK, if anyone wants to get my friends and family together to discuss our problem, I am happy to sit on the couch and listen. But I bet that even the most “cup is half-full kind of person” has to think a little contrarian after this “take your Prozac after reading” piece. Am I wrong?

Thanks for reading. We appreciate you. Trade and invest carefully.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.