The Weekly Random Walk – August 14, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Humpty Dumpty

Unless you lived under a rock, you know the nursery rhyme about Humpty Dumpty. The rhyme initially came from a British riddle that typically portrayed the character as an anthropomorphic egg. Unfortunately, we are unsure of the egg's pronouns in the 1800s, but we suspect they were “sunny side up” and “scrambled.” The first recorded version of the rhyme dates back to 1870 in James Williams Elliott’s Nation Nursery Rhymes and Nursery Songs.

The rhyme is one of the best-known in the English language:

Humpty Dumpty sat on a wall.

Humpty Dumpty had a great fall.

All the king's horses and all the king’s men.

Couldn’t put Humpty together again.

We have so much data; most show cracks in the economy and markets (yes, the puns will be flying this week). At some point, it will come back “together again,” – but for now, we want to explore the possibility of the fall.

Losing Its Balance

Last week, the ten and thirty-year UST reached their highest level since 2008. Between June 2020 and November 2022, there was an 85% correlation between real yields and the S&P 500s price/earnings (P/E) ratio. Earlier this year, that correlation completely broke down with excitement over AI and the “greater” likelihood of a soft landing. This has led to a surge in P/E ratios and overbought conditions despite the elevated real rates.

But as we cautioned over the last few weeks, the tailwind to markets has become a crosswind, and equities are losing their balance. The move in equity markets over the previous few weeks indicates they are again sensitive to real rates as some of the euphoria comes out of the market. The 30Y UST now sits at 4.26%.

Will Rates Rise or (you guessed it) Fall

A study by the New York Fed based on its survey of primary dealers that takes place in advance of every FOMC meeting shows that since COVID, the dispersion of responses for the level of Fed Funds (prognostication) in the next 7-9 quarters has widened considerably relative to its pre-COVID norm. The gap between the 10th and 90th percentile of responses has averaged 350 bps (or 3.5%) versus 100bps (1.0%) before COVID. The study also showed that the source of the disagreement was due to different economic outlooks as opposed to Fed forward guidance (dot plots).

Frankly, anyone in our position is purely guessing (we think our guess may be correct) because we have never faced an economic shutdown, trillions added to the money supply, and the cause and effect that creates. So, data is our friend, and we continue to let that tell the story (and guide our forecast).

You’re Kool-Aid Is Spiked (Oh Yea!!!)

Those in the FOMO (fear of missing out) mode and who have chased the markets saw investments turn red over the last few weeks. The S&P 500, led by technology stocks, show vulnerability to some of the crosswinds mentioned. The FOMO trade had gone 47 days without a 1% sell-off, so they were getting used to low volatility and the steady climb higher. That winning streak has come to an end.

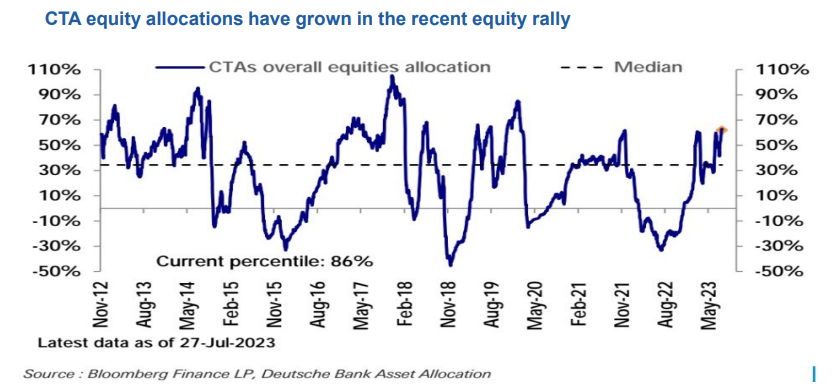

According to Deutsche Bank, those systematic equity funds (quants) and CTAs (commodity trading advisors) may have taken too many sips of the spiked Koolaide because they went net long in their allocations (up to the 86th percentile). As you can see in the chart below, they have been higher, but just as they build up long positions, these fast traders will sell. If we see further downside pressure on the S&P 500 and a continuation of realized volatility, we could see a sharp correction in stock prices as these fast traders switch their positioning.

A Plumbers Backside

Maybe it's loose boxers, or they like going commando, but no one likes seeing the backside of a plumber when they are working on our sinks (you’re welcome for the visual). But just as ugly is the Household Debt and Credit report the Fed released for the second quarter of this year. These statistics show potential cracks (yep, to the pun) in consumers' ability to spend going forward because of the leverage on their balance sheets.

Some of the highlights are:

Balances are now at 17.06 trillion dollars, an increase of 16 billion from the first quarter.

Mortgage balances and refinances were essentially unchanged.

Credit Card balances increased by 45 billion, and aggregate limits now stand at 4.6 trillion dollars.

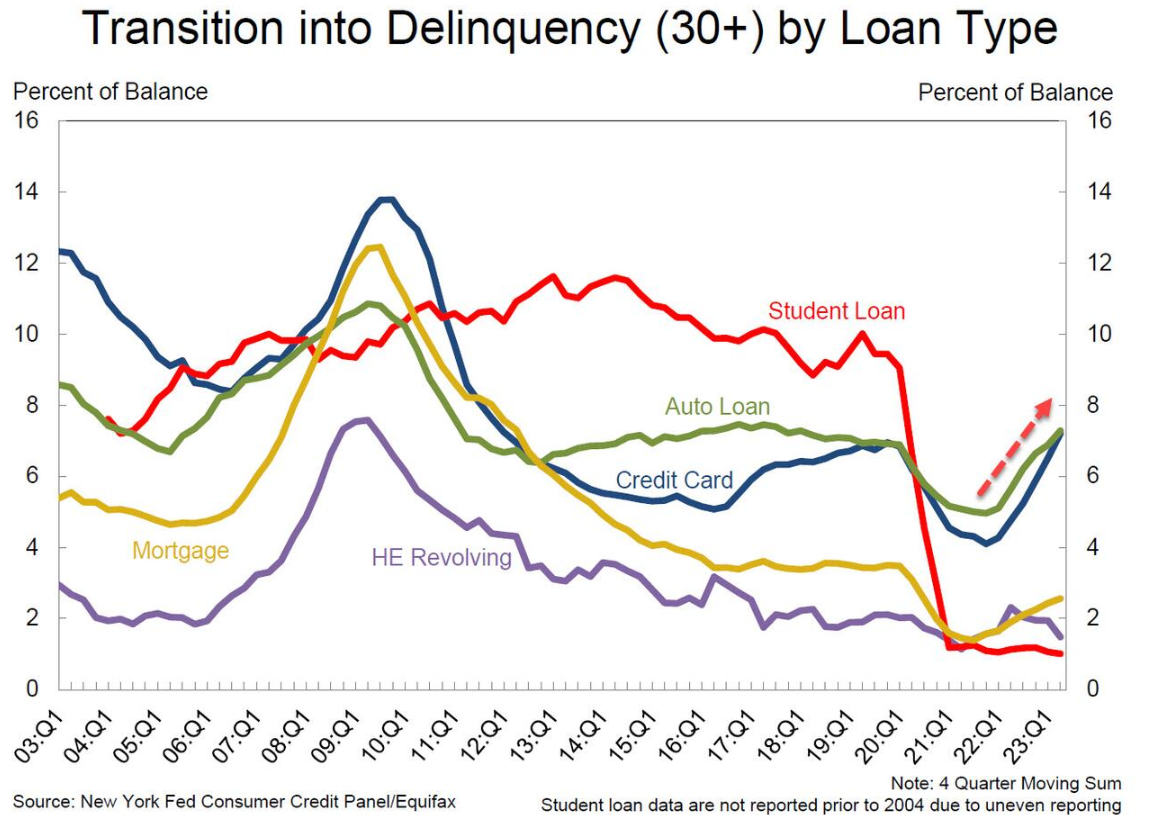

The butt of this report (yep, 2x) is that credit card and auto loan delinquency rates continue to rise. These generally don’t rise when there are good economic conditions (for example: look at the delinquency rates in 2007, as they rose before the economy and markets got bad). So if nothing else, it’s a pretty big yellow flag on the economy.

We Fail

Something that caught our attention was the comments made by David Tolley, Interim Chief Executive Officer at WeWork (stock symbol WE). Last week, Mr. Tolley stated, “Excess supply in commercial real estate (CRE), increasing competition in flexible space, and macroeconomic volatility drove higher member churn and softer demand than we anticipated, resulting in a slight decline in memberships.”

But digging into their 10Q filing, the company continues to lose money and is projected to need additional cash; with it, there would be substantial uncertainty and doubts about its ability to continue. As of close Friday, it was trading at 20 cents a share.

As the late Paul Harvey would say, “And now for the rest of the story.”

Beyond the competition aspect, this could be another yellow flag for small businesses. These flex space options have become the bread and butter for business owners needing office space. If “macroeconomic volatility” is code for small businesses struggling, this is another sign of future recession. Since companies like WeWorks can be utilized on short-term leases, small businesses would cut that expense first and move back to a work-from-home environment. This is speculation on our part, but if the stock chart (below) is any indication, WeWorks is becoming a WeFail.

Humpty Is A Fat Egg

Hopefully, Humpty doesn’t get offended by us calling him a bit large.

Last week Bloomberg did an interesting study on the balance sheet positioning of various firms. Unsurprisingly, the most prominent US firms have become entrenched (almost monopoly-like) as they outspend on capex and buybacks. At the same time, smaller companies defensively build up cash levels.

This makes picking stocks very difficult as it’s almost unavoidable not to own the largest stocks. This creates a snowball effect and increases their market cap. In the Bloomberg study, this trend may continue as these firms fortify their balance sheet and business (look at the banking sector as a great example).

The gap between the most prominent and smallest companies can be seen in the chart below. Since 1990, a portfolio of the ten largest companies in the S&P 500 rebalanced monthly (which is too much and not tax-efficient) has returned 37x versus only 2.3x for the bottom 250 companies in the index.

If these companies fall, like overweight Humpty, they will land with a thud and pull the indexes down with them.

All The Kings Men

Last weekend I got great advice from a dear friend (thanks, KW). With our connectivity to DC (via lawmakers and staffers), she suggested we discuss policy if/when we hear something interesting.

The conversations this week point to September 14th (11:50 pm), which is circled on the calendar. For those who don’t know, this is the deadline for a new contract between the United Auto Workers (UAW), representing nearly 150,000 workers, at the three unionized automakers.

According to those on the hill, there is better than a 50/50 chance that the UAW will strike on September 15, 2023. The union is making significant demands at a time of rising union assertiveness and ambition. All three automakers with expiring contracts have amassed nearly 250 billion in reported profits over the last ten years. But beyond just pure profit share, the UAW has found inequity in union pay which could prove a very sticky issue for the Biden administration and Democrats as they head to elections in 2024.

The issue is about EV manufacturing. The big three manufacturers have a loophole allowing them to pay less to a “joint-venture.” worker (where the EV batteries are made overseas). The UAW is seeking level wages and benefits at all “joint-venture” operated plants in the US.

Since EVs are far more expensive to manufacture (most US automakers are currently losing money on their EVs), moving workers in (for example) Lordstown, Ohio, up to $32 an hour from $16.50 reduces the profitability because of increased labor cost. Over time, the question is if they would keep the manufacturing in the US or move it to Mexico, where they can pay cheaper wages. This is a major “rock and a hard place” issue for the Biden administration, which continues to promote EVs and at the same time promotor of union workers (note: according to those I spoke to, they knew about the disparity of pay, but the agenda of EVs, in their opinion, was more important).

Below is a chart of Ford (F). It appears the market is starting to price in a potential strike. All of the automakers have been under pressure over the last week.

If the UAW does strike, add this to the list of unions like; screenwriters, actors, healthcare workers, and hotel workers at Amazon, UPS, and FedEx, who have all gone on strike in 2023. Unions certainly feel empowered with Biden in office.

However, If you have a “D” in front of your name, you want a deal before September 14th to avoid a prolonged strike and the MSM picking up on the disparity of pay issue. This is a large part of your voting base, and you want to keep it.

Can Superglue Fix The Crack (This Weeks Bullets)

Disney announced a significant price increase in their Disney + and Hulu streaming services. Disney + will cost $13.99, up from $10.99 (a 27% increase), and Hulu will go to $17.99 per month, up from $14.99 (a 20% increase). This is the second time in a year that Disney (DIS) has raised prices on their streaming services. But don’t worry; inflation is returning to 2% (insert some sarcasm here).

Someone may want to tell President Biden that gas prices are increasing and any commentary that continues that upward trajectory is not good for his reelection bid. Last week the President told Stephanie Abrams with The Weather Channel – “I wanted to stop all drilling on the East Coast and the West Coast and in the Gulf (of Mexico). But I lost in court. We’re still pushing really, very hard.” Biden said that his administration has “practically” called a national emergency on climate change (we are not sure what that means). Still, when Karine Jean-Pierre was questioned, she (in spin speak) admitted that an emergency hadn’t been declared. No matter the party and the subject, it’s always best to have a clear and concise message when talking to the public. However, on energy, this administration has been anything but clear, and we suspect it will get more complicated as WTI continues to climb.

Both equity and bond markets jumped higher last Thursday on the CPI report, which showed inflation rose 3.2% in July, up from 3% in June (expectations were for a 3.3% rise). As discussed last week, we did not anticipate higher energy prices to be reflected in July’s numbers. However, we do think that August numbers will start to show a slight uptick in inflationary pressure and even more so in September. We would caution those who think it’s clear sailing from here. We believe there may be some more work to do.

Humpty’s cousin Humchi (yes, that’s made-up) also seems to have fallen. The latest news about China’s economy shows that a large amount of credit stress is exploding, and local government financing vehicles (LGFVs) are openly cracking with a record number of missing payments on a popular type of short-term debt. Their missed payments amount to 1.86 billion (yuan), more than double the 780 million in June. That’s got to make Winnie the Pooh nervous (this is the nickname for Xi Jinping, hence why he has banned the film in China) as he and his government will allow provincial-level governments to raise one trillion yuan to repay the debt of LGFVs. This is a game the US is playing, and at the end of the day, the debt is still there. Glad Winnie is smiling (that’s a doppelganger if we have ever seen one).

The markets received a slight boost from CPI last week, but we are still in the "correction is coming" camp. Resistance has formed on the S&P 500 at 4600, which is well above our early-year targets. We believe the Fed may allow the market to suffer for a while before intervening. Therefore, we believe that the markets may become somewhat unsettled. Based on the data we have seen (and shown you), a soft landing does not seem likely (although we hope we are wrong).

We will be out and about for the next few weeks, so expect shorter updates. We will resume the long format in September as things heat up.

Thank you for reading. We appreciate you. Trade and invest with caution.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.