Last Week in Review – July 17, 2023 – from Stephen Colavito

Last week stocks recorded substantial gains as investors welcomed data showing a continued cooldown in inflation. The S&P 500 Index ended the week 6.50% below the all-time intraday high it established in early 2022. The Nasdaq Composite recorded an even more substantial gain but remained 12.94% below its record peak. Standout performers within the S&P 500 included casino operators, regional banks, and asset managers. Laggards included some major pharmaceutical firms and the typically defensive consumer staples sector. Friday saw the unofficial start of earnings season, as bank giants Citigroup, JPMorgan Chase, Goldman Sachs, and Wells Fargo reported second-quarter results.

US - MARKETS & ECONOMY

The signal event of the week appeared to be Wednesday’s release of consumer price index (CPI) inflation data. Both headline and core (excluding food and energy prices) inflation rose 0.2% in June, a tick below expectations. The annual increase in headline inflation slowed to 3.0%, its slowest pace since March 2021, while core inflation slowed to 4.8%, the slowest since October 2021.

Producer price index (PPI) inflation data, released Thursday, was arguably even more encouraging. Headline producer prices rose only 0.1% over the year ended in June, nearing deflation territory. Core producer prices rose 2.4% over the period but near the Federal Reserve’s overall inflation target of 2.0% and at their slowest pace since January 2021.

Other data released during the week suggested that the economy might be able to skirt a recession as inflation cooled, resulting in a “soft landing.” Last Friday, markets appeared to get a boost from the University of Michigan’s gauge of current consumer sentiment, which rose well above expectations to 72.6, its highest level in nearly two years. They marked its largest monthly advance since 2006. Consumers reported better labor market conditions and falling inflation as reasons for improved optimism. Weekly jobless claims, reported Thursday, fell back more than expected to 237,000, reversing almost all of the previous week’s jump.

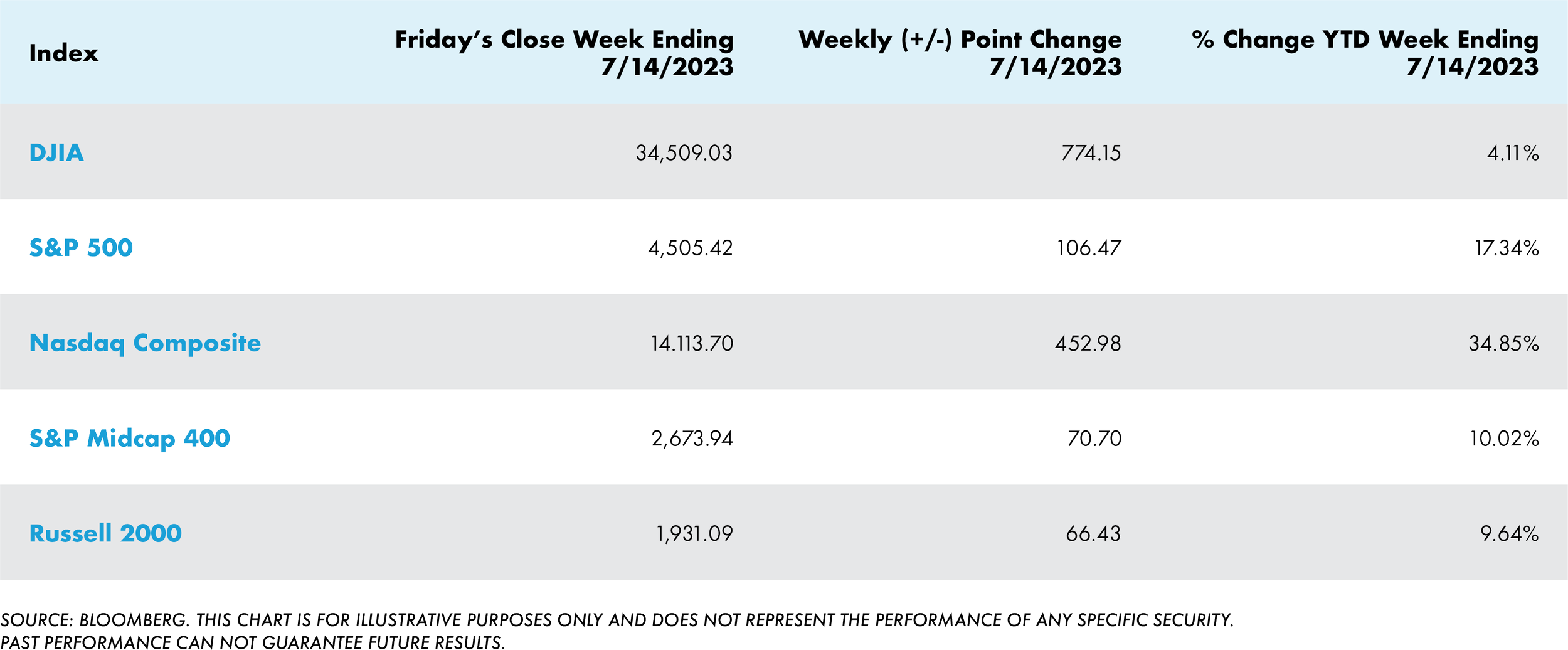

US – EQUITY MARKET PERFORMANCE

US YIELDS & BONDS

Last week US Treasury prices jumped as longer-term yields retreated on the positive inflation data, with the yield on the benchmark 10-year note falling below 4%. (Bond prices and yields move in opposite directions.) Supportive technical conditions remained in the municipal bond market, with reinvestments from coupon payments and bond maturities leading to solid demand for municipal bonds.

Spreads in the investment-grade corporate bond market tightened early in the week, led by more volatile issues. Total weekly issuance was near the lower end of expectations, while issues early in the week were oversubscribed. The high-yield market was relatively quiet, with light trading activity as investors awaited inflation data. Below-investment-grade bonds traded higher as broader risk markets and rates rallied following the soft CPI print and better-than-expected PPI figure. Investors will now focus on earnings as several big banks began reporting on Friday.

In addition to the broader risk rally, a technical imbalance contributed to the positive tone in the bank loan market with limited supply outside of higher-dollar loans. At the same time, buyers were primarily focused on discounted names. They noted that the secondary market was very well bid as issuance needed to catch up with demand.

US TREASURY MARKETS – CURRENT RATE AND WEEKLY CHANGE

3 Mth +0.01 bps to 5.35%

2-yr: -0.05 bps to 4.77%

5-yr: -0.31 bps to 4.05%

10-yr: -0.25 bps to 3.83%

30-yr: -0.12 bps to 3.93%

INTERESTING NEWS OVERSEAS

In local currency terms, the pan-European STOXX Europe 600 Index ended the week 2.95% higher—the biggest weekly gain in about three-and-a-half months. Signs of cooling inflation in the U.S. suggested that interest rates may soon peak. Meanwhile, China extended support measures to the property sector, raising hopes that additional economic stimulus could be forthcoming. Major stock indexes advanced. France’s CAC 40 Index climbed 3.69%, Germany’s DAX added 3.22%, and Italy’s FTSE MIB gained 3.19%. The UK’s FTSE Index 100 tacked on 2.45%.

European government bond yields fell as slowing U.S. inflation raised expectations that the Fed is nearing the end of its policy tightening cycle. UK bond yields also declined, but robust wage data cushioned the drop.

The minutes of the European Central Bank’s (ECB) June meeting showed support for further rate increases amid concerns about persistently high inflation. “It was seen as essential to communicate that monetary policy had still more ground to cover to bring inflation back to target in a timely manner,” the minutes said, adding that increases in “interest rates beyond July” could be considered “if necessary.” However, most policymakers backed chief economist Philip Lane’s argument that they should follow a “meeting-by-meeting approach, particularly as rates were moving closer to a possible peak level.”

Japanese equities lagged behind their Asian peers over the week, missing out on a regional rally driven by favorable developments in the China technology space and hopes of further Chinese stimulus. The Nikkei 225 Index generated a flat return, and the broader TOPIX Index fell 0.7%.

Growing expectations that the Bank of Japan (BoJ) could adjust its yield curve control framework as early as its July 27–28 meeting (having last tweaked it in December 2022) exerted upward pressure on domestic yields. The 10-year Japanese government bond (JGB) yield rose to 0.47% from a prior 0.44%, nearing the 0.50% level at which the BoJ caps JGB yields.

The yen strengthened to around JPY 138 against the U.S. dollar, from about JPY 142 the previous week, in anticipation of monetary policy normalization and the prospect that the BoJ raises its inflation outlook for this fiscal year in July. Conversely, the greenback struggled as U.S. producer prices grew less than expected in June, which investors perceived as increasing the likelihood that the U.S. Federal Reserve could be closer to ending its interest rate hiking cycle.

Lastly, Chinese equities rallied after Beijing telegraphed measures to support the country’s flagging economy. The Shanghai Stock Exchange Index rose 1.29%, while the blue-chip CSI 300 added 1.92%. In Hong Kong, the benchmark Hang Seng Index gained 5.71%.

Chinese officials announced extending two of the 16-point stimulus guidelines rolled out last November to support the ailing property sector. The extended policies aim to defer property development loans and encourage financial institutions to ensure the delivery of projects and will be in effect until the end of 2024.

In corporate news, China’s financial regulators imposed a more than USD 1 billion fine on technology giants Ant Group and Tencent Holdings. The penalty was widely interpreted as ending more than two years of probes into China’s biggest internet companies and a broader tech sector crackdown that spurred investor concerns about Beijing’s shifting approach to private enterprise.

On the economic front, China’s CPI remained unchanged in June from a year earlier and marked the weakest reading since February 2021. Core inflation, which excludes volatile food and energy prices, slid to 0.4% from the previous month’s 0.6%. The PPI slipped to a lower-than-expected rate of 5.4%, its ninth consecutive monthly decline. The data pointed to increasing deflation risks in China’s economy and more evidence that the country’s post-lockdown recovery is weakening.

THE WEEK AHEAD

The highlight of this week will be earnings reports from a range of prominent companies, including Bank of America, Morgan Stanley, Goldman Sachs, IBM, Netflix, Tesla, Johnson & Johnson, Philip Morris International, and American Express. Regarding macro data, United States retail sales are expected to grow at a moderate pace of 0.4% in June. On the other hand, industrial production is projected to contract by 0.1%, marking the second consecutive month of decline. Also, there are expectations of a reduction in June's building permits and housing starts, as well as in existing home sales. Other economic data to watch include homebuilder sentiment, business inventories, overall capital flows, and regional activity indexes such as the NY Empire State Manufacturing Index and the Philadelphia Fed Manufacturing Index.

Stephen Colavito

Chief Investment Officer

San Blas Securities

This message is informational and should not be construed as a solicitation or offer to buy or sell securities or other financial instruments. Past performance is not a guarantee of future results. San Blas Advisory is a registered investment adviser. More information about the firm can be found in its Form ADV Part 2, available upon request.