The Weekly Random Walk – September 18, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

House of Cards

“House of cards” noun; phrase: a structure, situation, or institution that is insubstantial, shaky, or in constant danger of collapse.

When people use the phrase “House of Cards,” most may think about the Netflix series with two great seasons (then went off the rails) starring Kevin Spacey and Robin Wright. The story is based on Frank Underwood (played by Spacey), a Democrat politician from South Carolina’s 5th congressional district, and his equally ambitious wife Claire Underwood (played by Wright).

This week’s “random walk” will focus on the economic aspects of housing, the phrase that may be true relative to the economy, and like Frank Underwood, some of the dicey moves by the political class that could put a struggling economy into a more significant economic headwind.

Season One

Real Estate markets are about to do something they haven’t done since 2005 (remember what happened three years later). Existing home prices are about to pass new home prices. The cost of a median new home sales price is now down to $416,000. Meanwhile, the median existing-home sales price is up to $396,000.

Existing home prices are on track to pass new home prices by the end of the year. As discussed in the past, no one wants to sell their home and lose their 3% mortgage to purchase another home with a mortgage at 7.5%. The system is broken when an old house sells for more than a new home.

Season Two

The conclusion that the reason why housing is unaffordable is a scarcity of housing misses a key dynamic in the economic law of supply and demand. Yes, it has some effect, but another key is WHO has money and where they park it.

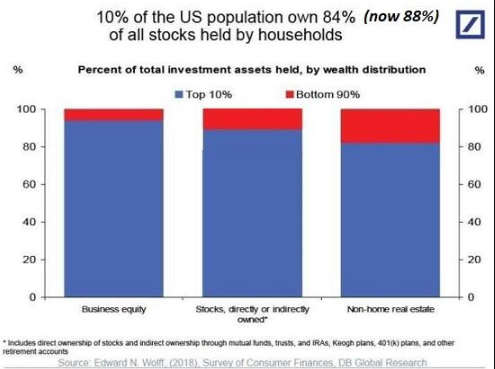

As the Fed has become a more “active” central bank, they have turned the US economy into a bubble/bust economy that funnels the vast majority of gains into the top 10% who own 90% of income-producing assets. This started with former Fed Chair Paul Volcker and continues with current Fed Chair Jerome Powell (and all Chairs in between). Bubbles create and distribute wealth asymmetrically, and those with it can accumulate more assets during economic busts.

The chart below shows the top 10% of the population own 88% of all stocks.

Corporations and the super-wealthy have been buying houses as rental properties. The excess wealth created by the Fed is constantly seeking a higher return, as rents have soared (chart below), rental housing has been seen as a safe and profitable haven for the trillions of dollars (created by the Fed and Treasury) floating around seeking a low-risk high return.

Season Three

In the next few months, gas may become “unaffordable” as well. Last week, WTI went over the $ 90-a-barrel mark, and there is no reason to suspect that assentation will slow down anytime soon. Several members of OPEC+ came out last week to discuss the massive supply shortfall facing the global markets next quarter. The current shortfall estimate is around 3 million barrels per day. If these officials are correct, this would result in the most significant inventory drawdown since 2007.

OPEC will continue its voluntary production cuts of 1.3 million additional barrels of oil per day, and it would appear with little supply in the SPR, the Biden stickers saying “I did that” may come back to a gas pump near you.

More importantly, gas and groceries are the most significant non-discretionary budget items most families face. As gas prices increase, so do transportation costs for things like groceries. As we move closer to the holidays, this could be a double-whammy for families.

The battle over inflation is not over for the Fed.

Season Four

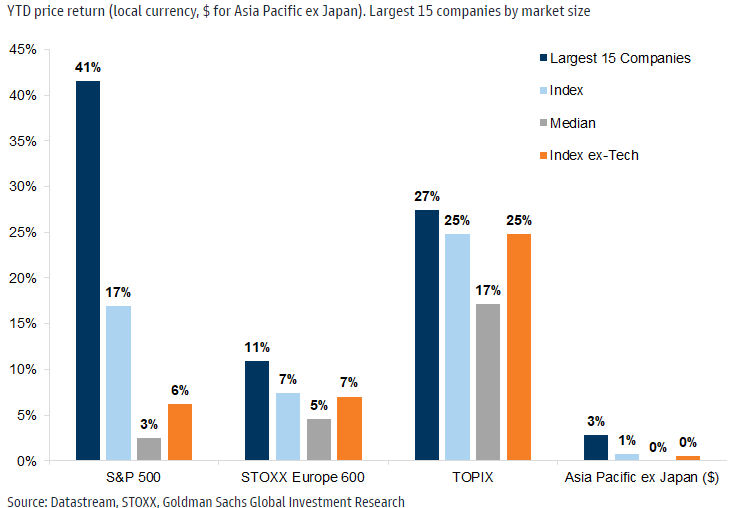

When looking at the S&P 500 Index or the Nasdaq Composite, one would think the “markets” are robust and that portfolios should be doing well. But as discussed in the previous “Random Walks,” this market is bifurcated into “the have’s” and “the have-nots.” The five stocks driving the price-weighted indexes are Apple, Amazon, Microsoft, Google, and Nvidia. With those stocks, here is the performance of two indexes:

S&P 500 YTD (Price Weighted): +15.91%

Nasdaq Composite YTD: + 30.97%

Take out those five companies or create an equal-weight index; the performance is much different. Anyone with a diversified portfolio will relate to the mid-single-digit returns that most indexes have for the year. Without or equal weighting, here is the performance of most indexes:

S&P 500 YTD (Equal Weighted): +4.95%

Dow Jones Industrial Average: +4.44%

Midcap 400 Index: +5.63%

Smallcap 600 Index: 2.49%

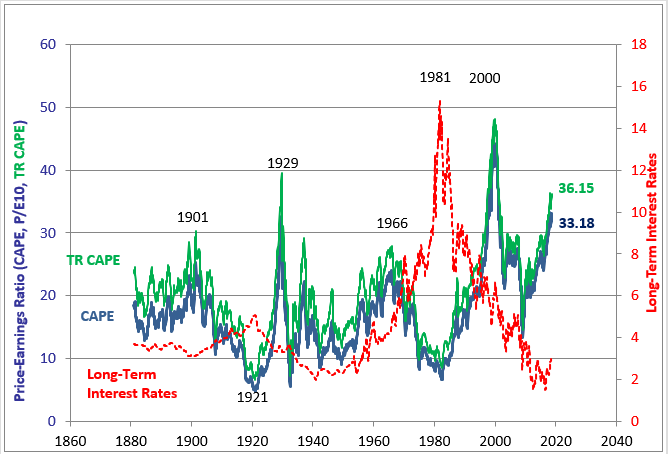

The performance of those few stocks has now taken Robert Shiller’s CAPE (Cyclically Adjusted Price Earnings Ratio) valuations up to levels not seen since 1929 and 2000 (see chart below). We would argue that money printing and zero rates helped move markets to nosebleed levels. We are desperately trying to find long-term reasons for markets to stay elevated from a valuation perspective but have yet to see the magic bullet (unlike the nurse who came forward last week in the assassination of JFK).

The bottom line is that diversified portfolios have not kept pace with “the benchmark index” (aka S&P 500). Investors would be wise to understand that “mean reversion” always happens (it’s a question of “when,” not “if”), and it’s essential to stay the course. Diversification wins in the long run.

Season Five

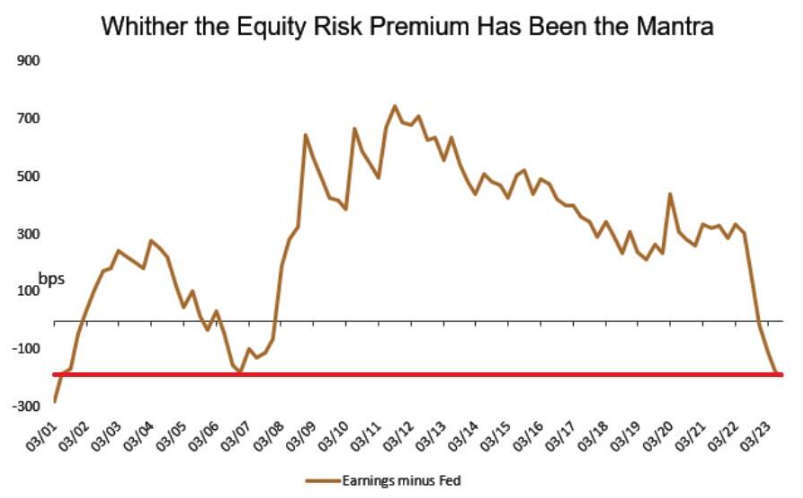

Beyond valuations, the risk premium investors demand from technology stocks is now at the lowest level since the dot-com bubble, underscoring the extent to which valuations have run up on those names. The prospective earnings yield on the Nasdaq 100 Index adjusted for the Federal Reserve’s benchmark rate turned negative late last year, with this year’s rally taking it further south.

The magnitude of the inversion was on a similar scale but less pronounced in the run-up to the financial crisis. Both the dot-com and 2008 financial crisis didn’t end well for investors, or maybe this time is different (because of an ultra-soft-cushy landing of the economy).

We only know that markets are expensive, which has historically led to corrections and repricing of assets.

“My Turn”

If you remember, at the end of season 5 of House of Cards, Claire Underwood becomes President after Frank resigns as President. The season ends with Claire ignoring Frank’s call, then breaking the fourth wall when she tells viewers, “My Turn.” So here are Claire’s best bullet points:

Last Wednesday, there were sharply different interpretations of last month's CPI number. The market wanted to stay focused on the month-over-month (MOM) number to keep the narrative in the bull's favor. But with Brent Crude at $93.39 and WTI at $91.20, the outlook for MOM or YOY isn’t good for the next few months. Several Professors we follow on X (formerly Twitter) were pelted in reply when they justified higher inflation. Despite the spin from the White House, it seems pretty clear the average American is feeling continued pressure of higher prices.

NPR posted an article that didn’t get much attention in the MSM as the title exclaimed, “Social Security is now expected to run short of cash by 2033.” The article highlights both parties' poor fiscal responsibility in Washington and that entitlements are in deep trouble in a very short time. Most of us would like to believe that the knuckleheads in DC would fix this before it goes insolvent, but unfortunately, Medicare runs out of funds two years before Social Security. We are starting to believe that maybe bankrupting the country is an intentional play to move society into a digital token (or currency). We realize this is for those who wear aluminum foil hats, but we are all ears if someone has a better explanation.

Since we have already gone down a rabbit hole, listening to European Commission President Ursula von der Leyen at the G20 Summit was ominous in context and substance. During her speech last week, she called for an international regulatory body for AI and a digital ID system similar to coronavirus vaccine passports. The system she suggested was similar to what China uses to monitor the social behavior of its citizens and establish a “social score.” These would be “globally accepted standards” akin to what they have on Climate Change (how’s that working out). Since we have some chicken to bake, we will pull the aluminum foil off our heads and use it for the oven. But we suggest watching this nonsense from politicians carefully.

You know crime is terrible when one of Nike’s original stores in Portland, Oregon, is closing, citing safety and security issues. The company confirmed that it would be “reimagining” the retail space (so, in essence, empty) and “considering future locations as part of this community’s long-term revitalization plan.” We don’t highlight this for political reasons but for economic. The ramifications of store closings mean lost jobs for those who need it most. Sale tax depletion for the cities and lost income tax for the state. Defunding police may save a few dollars in the short run, but it costs cities, States, and, more importantly, the residents much more in the long run.

No change (again) in our thoughts on equities. The market seems stuck in a trading range as all this data plays out. We remain selective buyers or bonds in the 3-5 year range.

Lastly, as predicted last month, the UAW has begun their strike of the big three auto companies. The strike is unusual because not all 145,000 members have walked out simultaneously. Instead, it has selected one large assembly plant for each company. According to the Anderson Economic Group, even a strike lasting as little as ten days would cost the economy 5.6 billion in economic losses.

Have a great week. Be safe and trade well!

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.