The Weekly Random Walk – October 16, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Just Data

After taking a week off, we have too many data points to cover. So, we are just giving you data this week instead of a cute title and weaving a story into this update.

Fixed Income

1) 10-Year UST

The last few weeks have seen a dramatic rise in the longer end of the Treasury yield curve. With the 10-year Treasury now hovering around 4.59% (as of last Friday), there are plenty of reasons why yields are up, and prices are down. China has announced they will continue to sell Treasuries to support their currency; quantitative tightening by the Fed and continued sticky inflation are just some of the concerns.

Morgan Stanley suggested that as the New York Fed’s ACM model of rate expectations has been relatively flat over the last few months, the rise in yields has been driven entirely by increased term premiums as investors potentially perceive less need for the protection of 10-year Treasuries due to consensus setting in regarding a soft landing when they can get higher yields in bills.

Higher yields also create macro-risks for Washington as more debt (one trillion in the last month) is issued to pay for over-spending by lawmakers in DC. The average yield for government bonds is around 3% but rising rapidly, adversely affecting the federal budget.

2) Outflows In Fixed Income

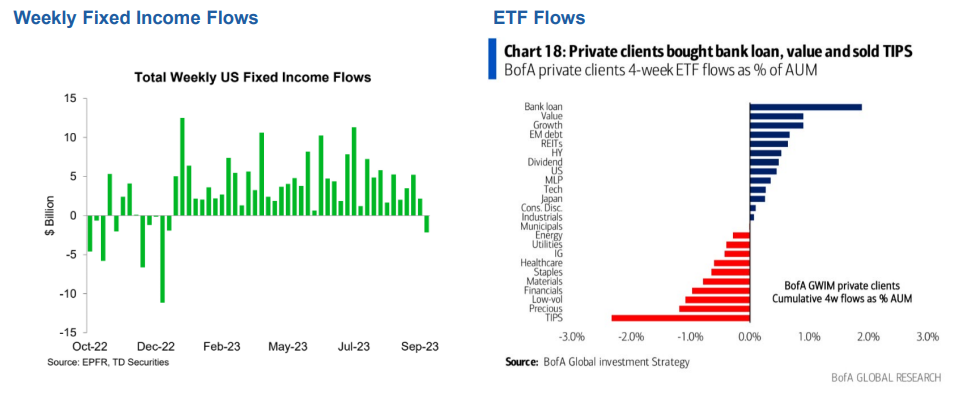

Despite the headline return in the S&P 500 (pushed up by seven stocks), most balanced investors are down since January 2022. Those long duration (via bond or mutual fund) have seen significant mark-to-market losses. So, over the last few weeks, fixed income flows have shifted and are now consistent with a capitulating investor (and advisor) base abandoning hope for a near-term reversal in monetary policy. Weekly flows into fixed-income ETFs turned negative for the first time, and according to Bank of America, their client base has reduced their TIPs exposure over the last month and increased their allocations to floating-rate bank loans.

3) High-Yield = Higher Defaults

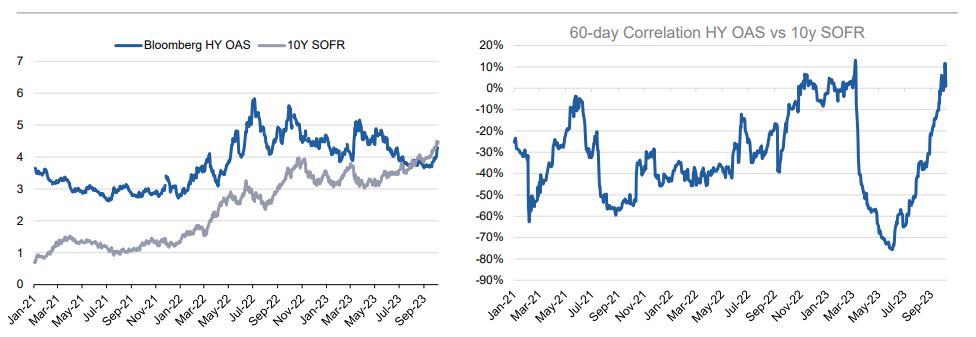

Over the last three weeks, we have seen high yield (HY) spreads widen alongside higher interest rates so that the 60-day correlation between HY and 10 SOFR has turned positive for the first time since the end of 2022. Last year, the HY market widened on concerns that persistent inflation would lead to long-term, high financing rates for HY, potentially leading to more defaults. This year, as inflation cooled, the HY market rallied, but sentiment has changed as the market digests the “higher for longer” view.

Sector Spotlight – Utilities

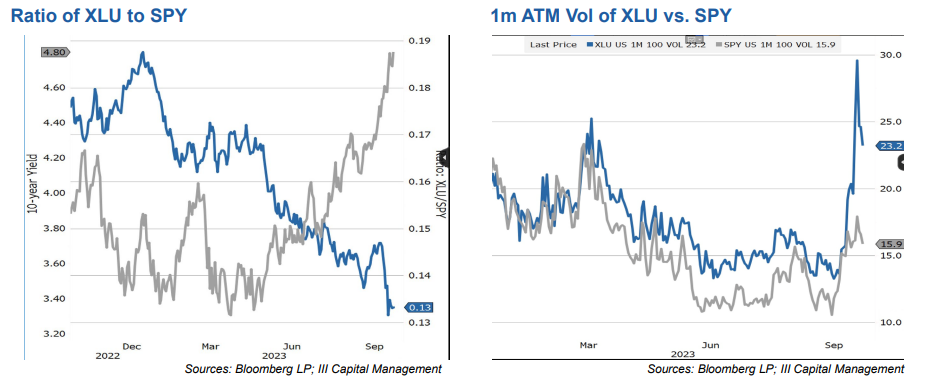

Dividend stocks – particularly a sector we like, utilities – took a massive hit over the last few weeks as interest rates continue to climb. The popular utilities ETF, XLU, fell more than 4% daily, deepening the sector’s underperformance relative to the S&P 500. Volatility was slightly more subdued this week, and the sector found a bid. Since utilities are leveraged companies, higher interest rates hurt their net margin.Since they are high dividend stocks, investors are leaving utilities to go into money market funds, paying more.

We think this sector needs to be watched and creates an opportunity as soon as bond markets stabilize or start moving lower in yield. Companies like Nextra Energy, Duke Power, and Southern Company have considerable market share and growing populations as people migrate into states where they provide services.

Equities

1) Equity Season and Santa Claus

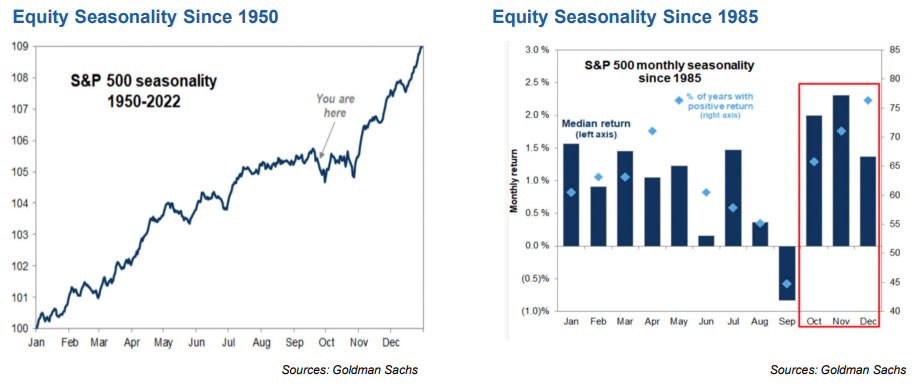

As the market passes through October, the seasonality of equities brings hope for the end of the recent equity market drawdown. Historically, the back end of October has been the second-best two weeks regarding total return. Going back to 1985, the S&P 500 has been positive 65% of the time and has delivered positive median returns of roughly 2%. This September’s performance, the only month with negative return seasonality, was consistent with the typical pattern.

The ”X-factor” is geopolitical issues, DC policy, and economic data that continue to embed risk. We hope the Santa Claus rally comes early and stabilizes equity prices (not just in 7 names).

2) Equity Valuations

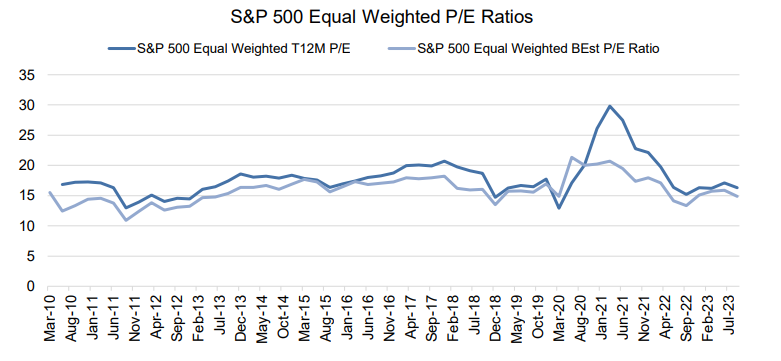

The “Magnificent 7” megacap stocks have an average forward P/E ratio of around 39, while the S&P 500 has a P/E of around 19.5xs (still rich). In contrast, the forward P/E of the equal-weighted S&P 500 is around 15xs, below the 16xs over the last 13 years. This highlights the valuation contrast in the market, with most companies priced for a soft landing (but not a mild recession, which would push valuations lower). This contrasts with the “Magnificent 7,” which is priced for explosive growth.

Bond markets will play a role in valuation if/when rates stabilize. Until then, we can expect volatility to be higher than the market has seen in the last several months.

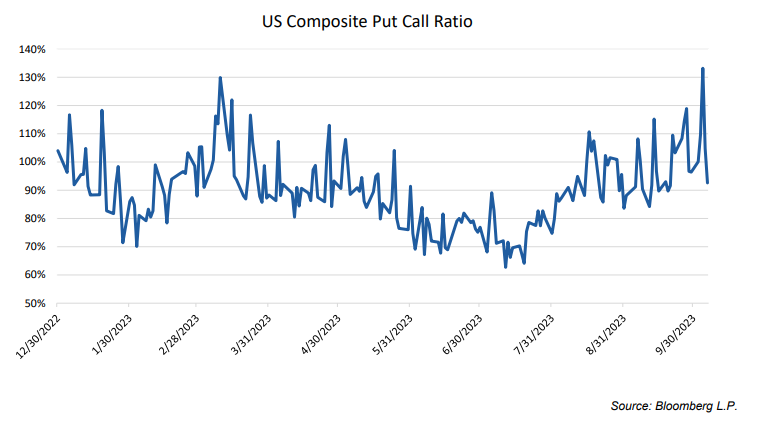

3) Puts

Over the last few weeks, the ratio of puts to calls (options) reached over 130%, the highest level this year, as investor concerns regarding the rapid pace of interest rate increases to the long end of the curve fed into equity weakness. Put buying is a hedge on markets, which is a sign that equity investors are still unsure of the direction of equities.

Economic Data

1) Leverage

As we discuss in these updates time and time again, leverage is the enemy of growth. Given that leverage in federal, state, local, corporate, household, student, and margin debt continues to climb, it’s hard to understand how the economy grows significantly even after the slowdown or recession ahead of us.

We currently live in the most highly leveraged economic era in US history. As of Q2 (which does not include the 1 trillion dollar increase in Federal Debt last month alone), the total measurable leverage in the economy is north of 97 trillion dollars. The entire economy is currently at just over 22 trillion dollars, requiring roughly 4 trillion in debt for each 1 trillion in growth. Critically, that level of debt has nearly doubled since 2008, when it stood at 54 trillion and the economy was roughly 16 trillion in value. This leverage was made possible by a Fed that took rates to near zero for over ten years.

As the great Milton Friedman said, we will pay for Federal spending in one of two ways: higher taxes or higher inflation (which slows economic growth). Economies can continue to borrow without a significant recourse in the future.

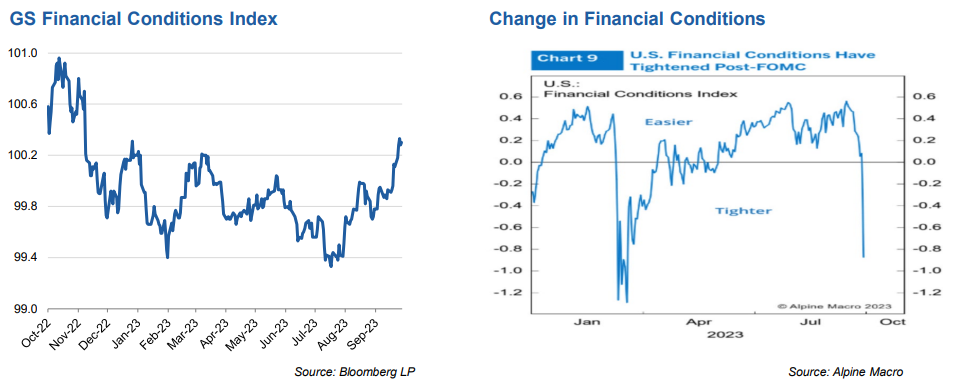

2) Financial Conditions

As inflation continues to remain elevated, higher rates, lower equities, wider credit spreads, and a stronger dollar have all contributed to tightening US financial conditions over the last two months. The pace at which conditions have become more restrictive is similar to the March banking crisis. Unless the various components reverse course, the tightening could add to the downside risk of an economy already showing signs of concern.

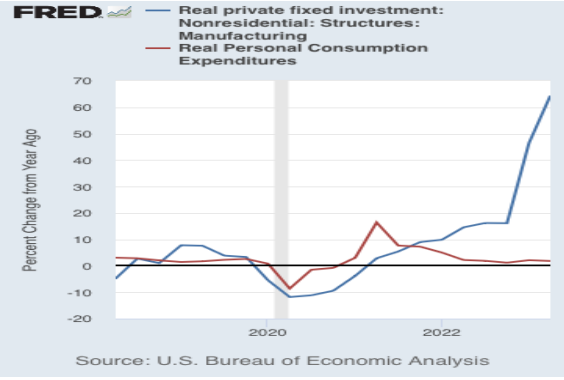

3) Consumer Spending

The continued revisions to the historical GDP over the last few weeks didn’t significantly alter the complexion of the data over the past few years. Still, the downward revision to Q2 Real Consumer Spending from 1.7% to 0.9% was notable. This should further dispel the narrative that the “consumer is still strong” (red line in the chart below) and instead highlight the remarkable contribution of Non-Residential Investment on Structures (factories – blue line). This measure is up over 60% on a year-over-year basis and is a result of some of the fiscal measures passed in 2022, such as the CHIPS Act and the Inflation Reduction Act.

As discussed earlier, the consumer is highly leveraged (credit card debt, etc.) and looks under budgetary pressure as debt and inflation cut into their budget. This could be one of the reasons we are starting to see an acceleration in delinquencies in both credit card and auto loans.

Given sticky inflation and slowing consumers, we find a soft-landing scenario hard to comprehend. Something has got to give.

Trading Data – Bullet Points

Equity markets are driven by the rate market (bonds) and the FOMC. But apparently, the FOMC is now starting to be directed by geopolitical events based on the dovish comments of several Fed officials last week. In talking with various desks, all that we spoke to were very defensive in their positioning, and with CPI and sloppy treasury auctions, “caution” seems to be the word most often spoken.

The market is still in the trading range. With the S&P 500, 4200 – 4600 is still the channel.

Volumes in equities are lower than usual this time of year, and most desks we spoke to reported being slow. It was the second lightest trading volume day of 2023 on Monday last week. The only sectors that were trading were utilities and energy (yield and defensive plays). Other than that, everything is slow.

Last week, we read several stories that nearly 1,500 small businesses filed for subchapter V bankruptcy this year, almost all that filed in 2022 (with a quarter left). Small business loans are seeing a tick-up in delinquencies and defaults, and those numbers continue to accelerate. With problems in the small and mid-size bank space (which do most of the small business lending), we doubt those banks will be willing to extend or adjust loan provisions despite the hardship.

Although big banks like JPM and Citi reported good numbers last week, smaller banks may be more vulnerable to housing than previously thought. The issue isn’t defaults like in 2008; today, banks are losing a lot of money on the mortgage itself. The cost of capital is more than what most people pay for their 30-year loans. This creates an ALM (asset liability management) mismatch that erodes earnings. Banks can thank the Fed for their ten years of zero interest rate management for this problem (i.e., SVB).

There is now another “X-factor” hanging over the market: a global war. Although talking heads in the MSM would say this is isolated to Ukraine and Israel, a poll this week said that 3 out of every 4 Americans are worried about a World War, and 6 out of 10 Americans are worried about a nuclear war with Russia and China. We have not seen these types of numbers since the Cuban Missile Crisis.

Between crime in the major cities (we were a victim last week) and the thought of global war, the ramifications could be that consumers stay in their homes and don’t go out as much, thus causing a greater risk for economic slowdown. Something to watch.

Thanks for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.