The Weekly Random Walk – November 27, 2023 From Stephen Colavito

An Aggregation of Various Economic, Market Research, and Data

Thanksgiving Week Edition

Thanksgiving is our annual national holiday celebrating the harvest and other blessings of the past year. With that in mind, this week is a simple theme of “thank you.” I am thankful for those of you who read my weekly rants. I thank my clients for their faith in our ability to navigate choppy markets. I thank my partners for their confidence in our ability to build a world-class platform at our firm. I am thankful for the love of friends and family who keep us going in the best and worst times.

The data continues to be mixed, but we are thankful that we are starting to understand better our economy and what we may see in 2024.

Diversification

Many investors question the benefits of diversification, asking why they shouldn’t own anything other than the S&P 500 or now 5% bonds. This is a valid question, and the answer is simple: no one knows who “the winners” will be. Even with the best crystal ball, no one can accurately predict the future; prudence requires diversification to withstand multiple possible outcomes.

To highlight our point, at the end of 2009, many investors were lamenting the “lost decade” in the S&P 500, which declined 0.9% per year. It may seem difficult to believe (or remember because investors have short memories). Still, at the end of 2009, investors questioned whether large-cap US stocks would regain their footing.

Fast forward to today, and we know that not only did the US large-cap stocks come back, but they have been so dominant it’s hard to imagine a scenario in which they’ll ever underperform again (hint: at some point, they will). But that’s always the case after a huge run – and the longer it goes on, the more investors believe in its permanence.

Thanksgiving Football

Nothing says Thanksgiving more than overeating and watching football in the afternoon. Having direct discussions (at 5-10 and 165 lbs., we knew our place wasn’t on the football field) with current NFL players and coaches, all say that a Superbowl-winning team needs all three phases of the team to be strong: offense, defense, and special teams.

We will discuss these three (football) phases regarding why diversification matters.

Defensive (Economic Slowdown)

There are clear signs that the economy is slowing and the consumer (the engine that drives GDP) is cracking. Case in point: serious credit card delinquencies have increased sharply this year, with the rate for the 30-39 group now higher than peak 2020 (Covid) levels. This is a clear sign the consumer is on the brink of collapse.

Smaller businesses are not doing much better as default rates in the US high yield (HY) and loans continue to rise. Most analysts are projecting that this trend will persist over the next one or two years as the impact of higher interest rates continues to weigh on higher-leverage corporate issuers. It is unusual for loan market default rates to be higher than HY bond default rates. Still, rising floating rate costs from loans and poorer credit quality in the loan market versus HY have led to higher loan default rates. Barclays predicts that next year's default rate will be +4.5% for bonds and +6.0% for loans. This may be a longer bond credit cycle than usual if interest rates remain elevated as bond issuers slowly refinance into higher coupons.

Offense (Lower Yields Mean Possibly Higher. Valuations)

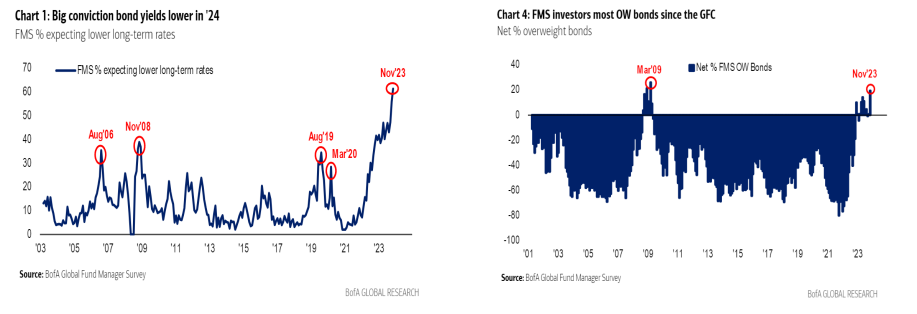

Lower yields could mean possibly higher valuations for equities in 2024. The market’s recent rally is indicative of the anticipation of lower rates.

Case in point: small caps have been solid over the last few weeks. IShares Russell 2000 ETF (IWM) rose 5.4%, outpacing the 2.3% advance for the S&P 500 over the same period. Equally impressive as the rally was the surge in call option volume. Over 4.2 million call options were traded on IWM last week, the most significant volume in the previous three years. Enthusiasm for small caps may be attributed to several factors, including the forecast of lower rates in 2024, record cheap valuation compared to large-cap stocks, and favorable seasonals that favor equities (Santa Claus rally).

“Smart money” is forecasting better valuations in equities as hedge fund positioning, according to Goldman, is the most crowded ever.

Goldman Sachs's prime book index came out last week, stating that hedge funds have held their most concentrated wagers on US equities in the past 22 years. This index created by the bank tracks crowding across hedge funds, and surprisingly, long/short hedge funds have moved from neutral to being long 70% of their portfolios (on average).

The most popular bets remain in mega-cap tech, with Microsoft, Amazon, and Meta as top holdings. The group of seven tech companies accounts for about 13% of the average hedge fund long portfolio, twice the weighting from the start of 2023. We are guessing the hedge funds' new motto is “If you can’t beat them, join them.”

Sector dispersion is one of the big themes we have highlighted in the market this year, with relative movements between the winners and losers at extreme levels. This year, the biggest winners in the S&P 500 were the largest stocks in capitalization. The S&P equal weight index has lagged the market cap index by 13.65%, the most significant underperformance since 1999. Another way to look at the severity of the dispersion is the contribution of the ten largest weights in the index to the total index return. So far in 2023, the top ten constituents have contributed 134% of the S&P return – the largest outperformance going back at least 30 years.

We highlight this (and hedge funds crowding into this trade) because, looking back on history, other sectors (large-cap value, small-caps, etc.) may play “catch-up” with the mega-cap tech names, and hence, we continue to preach diversification.

We believe in mean reversion and the extremes seen in this dispersion of equity sectors. The “haves and have-nots” only strengthen our conviction. (Note: This does not mean we think mega-tech can’t perform; it's just that other sectors could catch up.).

In 2024, equities could struggle in the first half of the year as signs of moderate recession (and earnings compression) become apparent. However, we are bullish on equities when either 1) they correct or 2) the Fed starts to lower interest rates, giving the market valuation expansion on P/E ratios.

Special Teams

Although unlikely during a football game, a punt return for a touchdown can change the momentum of a game. Investing in alternative investments can also have that same effect. Economies going through transition (see the update from a few weeks ago) often create volatility for public markets (stocks and bonds). So, investments with low or no correlations to public markets can be helpful during these economic times.

Although not necessarily an alternative, for those not qualified to invest in Private Equity, Hedge Funds, or Venture Capital, making a small sector bet can sometimes act as an alternative. We saw this a few days ago and thought we would share it for fun.

If you want to make a sector bet on your favorite political party, two ETFs mimic the holdings of Democrats and Republicans based on their disclosure filings (note: this is not an offer to buy or sell these securities; this is for information purposes only).

Looking at the chart below, the Democrats (blue – ETF symbol NANC) are outperforming not only the Republicans (Red – ETF symbol KRUZ) but also the S&P 500.

We found it funny the ETF for Democrats is NANC because, as we have reported before, Nancy Pelosi's reported net worth is north of 120 million on a House member salary. We will let readers dig into how she may or may not have obtained such a fantastic net worth.

On a serious note, Democrats tend to be highly invested in technology stocks, and Republicans in energy. In 2022, this benefited the KRUZ, but in 2023, technology has been the market leader, and the Democratic ETF NANC holds the performance advantage.

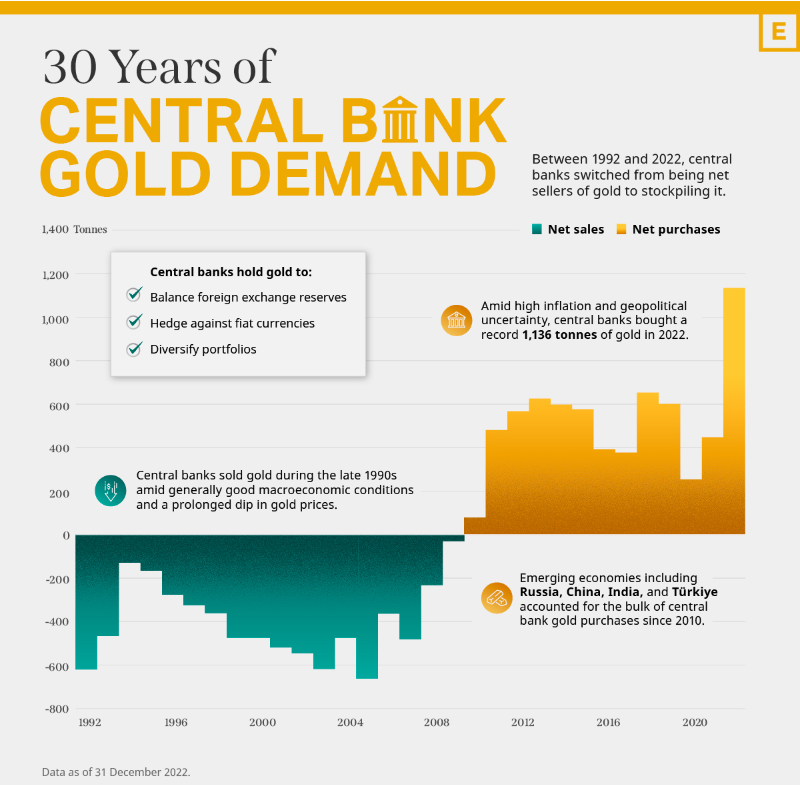

A genuine alternative and a real asset is gold. Over these many months, we have noted that we continue to see massive buying of this commodity from central banks. In fact, for the first nine months of 2023, official gold purchases hit 800 metric tons, more than in any January-September period in WGC data going back to 2000.

China is the biggest buyer, even encouraging citizens to buy the metal (one reason is that once it’s in China, there is very little chance it can leave the country). The Chinese had even announced a new currency backed by gold, similar to the US dollar before President Nixon ended the gold standard (which, in hindsight, was a massive mistake).

The chart below shows 30 years of Central Bank gold demand. They say, “Don’t fight the Fed” when investing. We wonder if the same is valid with global Central Banks (note: again, this is not an offer to buy or sell gold, and we are not selling coins as you see on certain TV stations; this is just for informational purposes only).

Since we have already taken up a lot of your time today (and we are running out of room), we will not go too deep into the alternative space other than to say that in 2024, we think having non-correlating assets in portfolios is another smart diversifier and critical to successful investing for the longer term.

Sweet Potatoes (Bullet Points)

This week's point is a simple one. We should be thankful. We live (currently) in a country where there are no wars. Although we have an economy that is likely to go through a downward cycle, it is pretty resilient. Our markets have (over time) provided excellent returns on our investments, and for this, we are grateful.

Lastly, we are thankful for those who read these updates. We are grateful for our clients who put so much trust in us. Those relationships mean the world to us, and (although we are not perfect) we will continue to work as hard as we can to provide the best risk/return to the portfolios that markets will allow. We are truly thankful.

Trade carefully. Thank you for listening.

Have a great week.

Stephen Colavito

Chief Investment Officer

San Blas Securities

stephen.colavito@sanblas-advisory.com

General Disclosures

This research is for San Blas Clients only. The opinions represented in this research are that of the CIO, not advisors or officers of San Blas Securities. This research is based on current public information that we consider reliable, but we need to represent it as accurate and complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. We seek to update our research as appropriate. Some research can and will be published irregularly as appropriate in the analyst’s judgment.

This research is not an offer to sell or solicitation of an offer to buy a security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or consider our clients' particular investment objectives, financial situations, or needs (individual or corporate). Clients should consider whether any advice or guidance in this research suits their specific circumstances and, if appropriate, seek professional advice, including tax advice. Past performance is not a guide for future performance, future returns are not guaranteed, and a loss of original capital may occur. More information on San Blas Securities is available at www.sanblassecurities.com.